Opening new store locations can increase brand exposure and generate revenue, but not conducting a proper feasibility evaluation means it might cost you. To make sure your retail expansion is an appropriate strategy, you should utilize systematic decision-making models including Critical Pathway Analysis (CPA). CPA allows you to analyze project timeframes, realistic resourcing and critical path execution referencing milestones that are important for making assessments in possible retail markets.

This tool is especially valuable when retailers consider geographic expansion into dynamic markets like Africa and the Middle East where there are substantial variances in infrastructure, consumer attitudes, and one-off competition. As there are many components involved in opening a store, including site selection and logistics for inventory, CPA helps you ensure a logical mapping of tasks with clear dependencies for each aspect.

Using CPA at the beginning of your market entry strategy strengthens the position of decision-makers when determining timeframes, costs, and risk by facilitating an ongoing review of your strategy in relation to market realities, competitive challenges, and consumer expectations.

Understanding Critical Pathway Analysis in Retail Expansion

Critical Pathway Analysis or CPA is a project management process that has transformed from being a project management tool to being a game-changing tool for retailers wanting to expand. The concept revolves around identifying the longest chain of dependent activities (which is also known as the critical path) that need to finish on time in order for the overall project to also finish on time. In retail, this means that every expansion roadmap has a basis for timelines and resource planning that is grounded in reality.

When you open new stores, there are interdependencies for every activity, and when one activity is delayed and falls on the critical path of the project, the entire retail rollout plan will be out of control. CPA makes those relationships clear and allows project teams to focus on the tasks that are really enhancing the project.

To illustrate, when entering new areas, each activity will require action simultaneously or in a particular order; for example, looking at demographic considerations, looking at how to be compliant in a new market, how to customize your marketing messages in the market, and coordinating construction activities. A CPA allows you to show them in a logical sequence with which to prioritize, and not to go through trial and error, and naturally, the team could stay within their budget.

CPA is also flexible. Whether you are entering the market in suburban Europe with only 5 stores, or launching 20 new stores in North Africa, it will help they to have a standard approach but will lend itself to the regionally specific nuances of each new market. Once integrated with retail KPIs and customer data analytics, CPA can provide the foundation for developing smarter, more strategic market entry strategies.

Site Selection and Demographic Analysis through Critical Path Mapping

Effective site selection is critical for retail rollout performance, and Critical Pathway Analysis makes it a systematic process. Choosing an unsuitable location can derail any planned retail rollout. CPA allows you to think about site selection not as a discrete process, but instead as an interconnected chain of events.

To begin with, demographic aspects such as income levels, population density, foot traffic, and local competition must be examined. CPA allows these research tasks to be plotted early in the timeline, so construction, hiring and supply chain tasks can only occur after securing an acceptable site.

For instance, if you are launching stores in a suburban area of Johannesburg, or Riyadh, CPA provides the ability to weave demographic analysis into layout planning, marketing tone and stock assortment absolving any chance of haphazardly making these decisions at the end of the process with no adequate lead time. Important dependencies such as landlord negotiations, approvals, etc. are also highlighted so that you are not blindsided by defaults or disruption that can cause bottlenecks.

With CPA you are not only selecting a viable site, but essentially validating that a viable site is possible to secure within the resources of time, budget, and strategic scope designed in your expansion roadmap. In rapidly changing sub-regions such as Africa and the Middle East, foresight allows more risk mitigation associated with local supply chain disruption and higher return on investment at store launch.

Integrating Competitive Landscape Assessment into the Expansion Roadmap

Before an organization can confidently commit to the expansion of its geographic footprint, it is fundamental that they understand the competitive landscape. Authoritative information on the competitive market is vital for framing your expansion roadmap. CPA integrates competitive intelligence into your roadmap in an actionable and timesensitive manner.

Through CPA, you will assign tasks for competitor assessments of things like: store footprints; pricing models; product assortments; and customer loyalty programs. These competitive insights will be fed into the site selection, marketing plan, and store design (all to be considered on your critical path). A competitive market assessment that fails to keep pace with the time-sensitive timing of a decision to choose a store format option, or pricing option, can jeopardize the long-term viability of the new market.

For clarification, if your expansion is to be comprised of new store footprints in Dubai or Nairobi, your CPA plan will ensure that you will set and benchmark performance expectations against existing retail players. This informs not only your descriptors of a differentiation strategy but establishes timing factors relative to when you will open, what monthly time frames you might avoid, and how quickly you can roll out multiple stores.

Finally, when competitive assessments will be integrated into other key objectives like recruitment and merchandising, CPA helps you translate sometimes raw market conditions into actionable in-market operational directives. It is this combination of key milestones in conjunction with competitive assessments that informs the precise competitive strategy of your market entry plan. You can better ensure that your market entry offer is distinct from established or potential competition, while capturing broader or developing markets throughout Africa and the Middle East.

Retail Rollout Plan with Timing, Dependencies, and Geographic Expansion

Regardless of how strong any area seems, retail rollout will only be effective if timelines are maintained and cash management ensures that dependencies are appropriately managed. Critical Pathway Analysis is the best way to chart geographic expansion of multi-location footprints, and manage either simultaneous developments or developments within the same regional space.

Let’s say you need to open ten stores in six months in the Middle East. CPA will allow you to map every dependency for opening a store (land acquisition, contract vendors, install POS systems, train staff, and so on) which will ultimately be the pathway to limiting “fire drills”, and managing cost overruns.

Retailers may also look to CPA from the perspective of ‘float time’ – which tasks can we allow to lag without impacting the overall rollout. For example, if you are waiting for permits for interior branding, you can allow that work to lag while moving forward with other aspects of the project.

This level of clarity will streamline the rollout and improve an operator’s market penetration. Retailers can determine rollout phases based on when specific cities are ready and can ensure that early wins are delivering financial and experiential capital for further efforts in that city. CPA can also provide scale – once you have determined the rollout for a market and built your framework, you can repeat that framework for future regions.

In distribution strategy for Africa and the Middle East, CPA uses a single brand across multiple countries, retains the agility of actioning local unique demands to ensure that every iteration of your marketplace outlet strengthens your retail growth strategy.

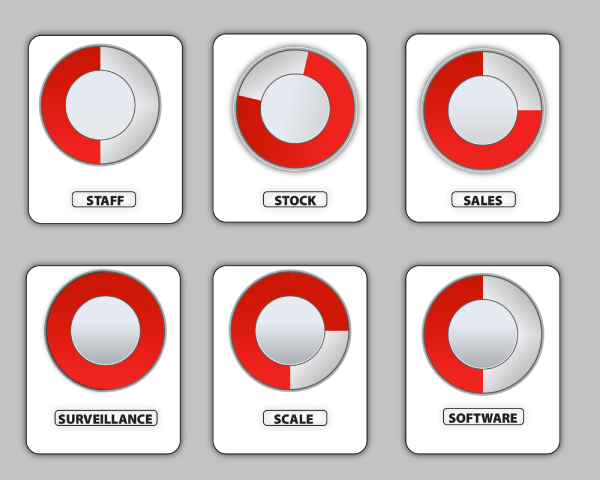

Retail Healthometer

Check the health of your business? Are you ready to organize & scale ?