What is pricing research in eCommerce?

Even a good product could get hammered in the online market space if not competitively priced. Competitive pricing reflects two things – prevailing prices charged by competitors and that customers are willing to pay these prices. Ecommerce pricing research is carried out to understand what constitutes this ‘competitive pricing’ in the online market space for one or multiple products (product mix) offered by competitors in the selected markets. Take for example a swimming merchandise brand. If the company wants to enter a new market, pricing assessment will be one of the important areas of decision-making. The brand cannot blindly start its services in the new market without consideration of the required changes in its pricing strategies. It could be possible that the same quality products are sold at higher prices by the competitors in the new market. Or a certain product type, say swimming ear plug, is available only in the premium band. In different cases, the pricing strategies shall vary depending on marketing and business goals. But having this information and insights on competitive pricing is critical.

In this blog, we shall delve further into the specifics of eCommerce pricing research and understand how it can help eCommerce brands in competitive pricing against their direct competitors. Indirectly, we are also trying to answer how to arrive at a good pricing strategy for eCommerce business.

Insights from eCommerce pricing research:

Focus price range of competitors vis-à-vis the product mix

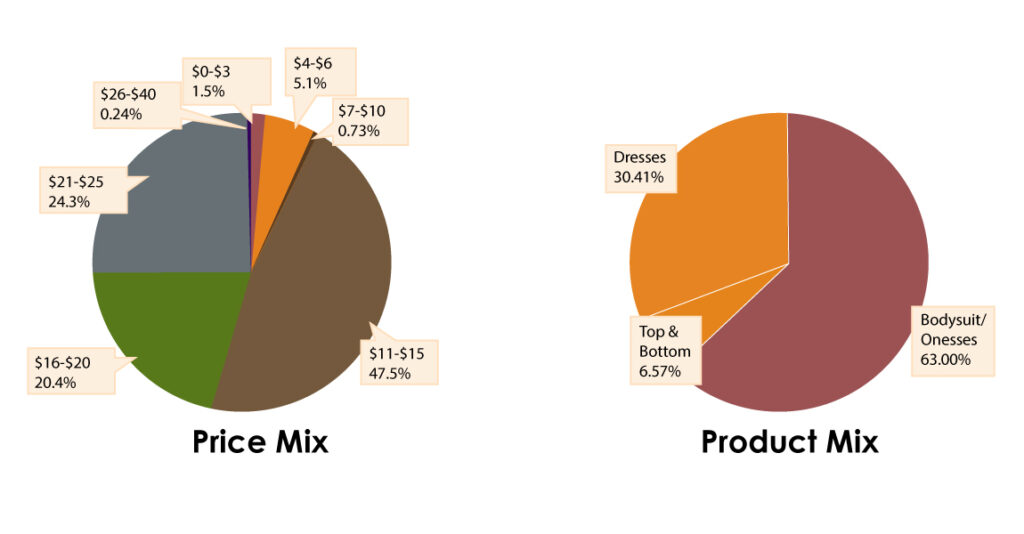

Pic1:

The visual above highlights the focus price range of a direct competitor. Close to 50% of the competitor’s product mix is in the price band of USD 10 to USD 15. This is the range within which the competitor has most of its products priced. The next two big price ranges are (USD 16 to USD 20) and (USD 21 to USD 25) contributing to 84% of the price mix. The competitor has a limited number of offerings in the higher ranges or the starting one. This data alone is not sufficient to deduce which product types or models fall in which price range. But it is good enough to draw that customers, in general, are most comfortable in the price range between USD 10 to USD 25 for any product type sold by the competitor. So, the host eCommerce brand needs to align its merchandising and pricing strategies focusing to extract the most from this price range. Focusing on this price range could help it quickly gain market share.

Focus price range of competitors vis-à-vis online marketplace platforms

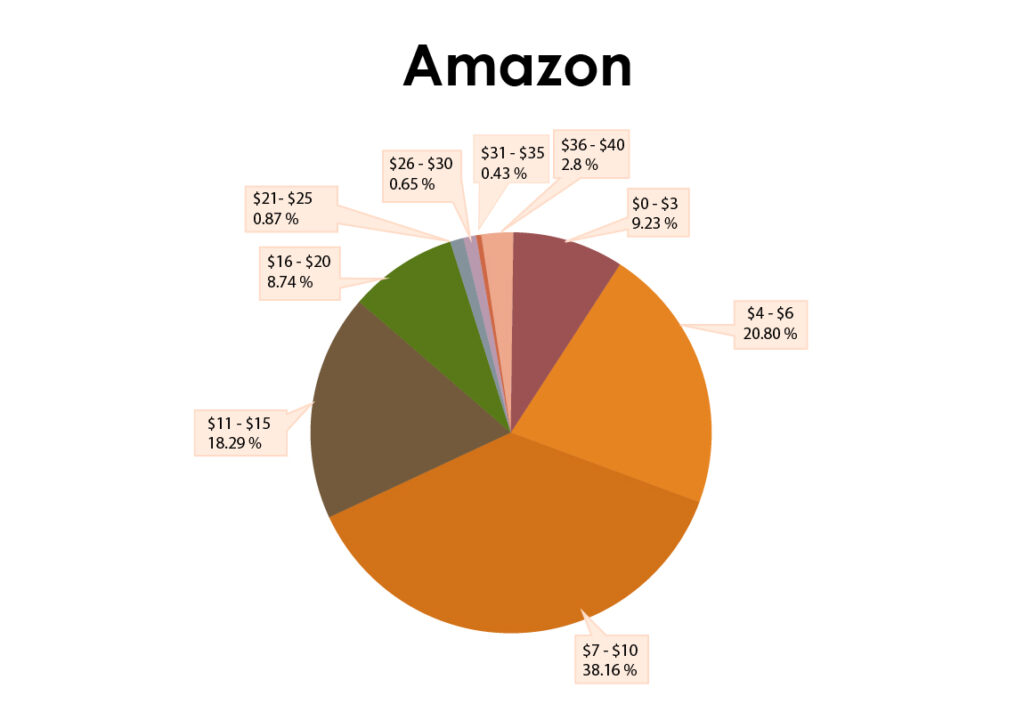

If you are intending to take the online marketplace route, then your pricing strategies are dependent on the prices charged by your direct competitors on the selected platforms. The visual below shows the price mix of a group of direct competitors selling on Amazon.

Pic2:

Almost 40% of the combined product mix is in the price range of USD 6 to USD 10. The other two largest ranges are (Below USD 6 contributing 20% approximately) and (USD 10 – USD 15 contributing 18% approximately). It could be construed that the epicentre of the market is in the price range of USD 6 to USD 10. A huge chunk of product types is priced in this band. If your product mix is close to these price ranges, you may not have to tinker too much with the price tags barring other business goals and market entry difficulties. The factor of dynamic pricing in eCommerce also plays a The product-price distribution map presents a detailed view of competitors’ pricing points across the product mix. The visual below is a representation of the pricing ranges of different product types offered by a group of direct competitors dealing in skincare products.

Product-Price Distribution

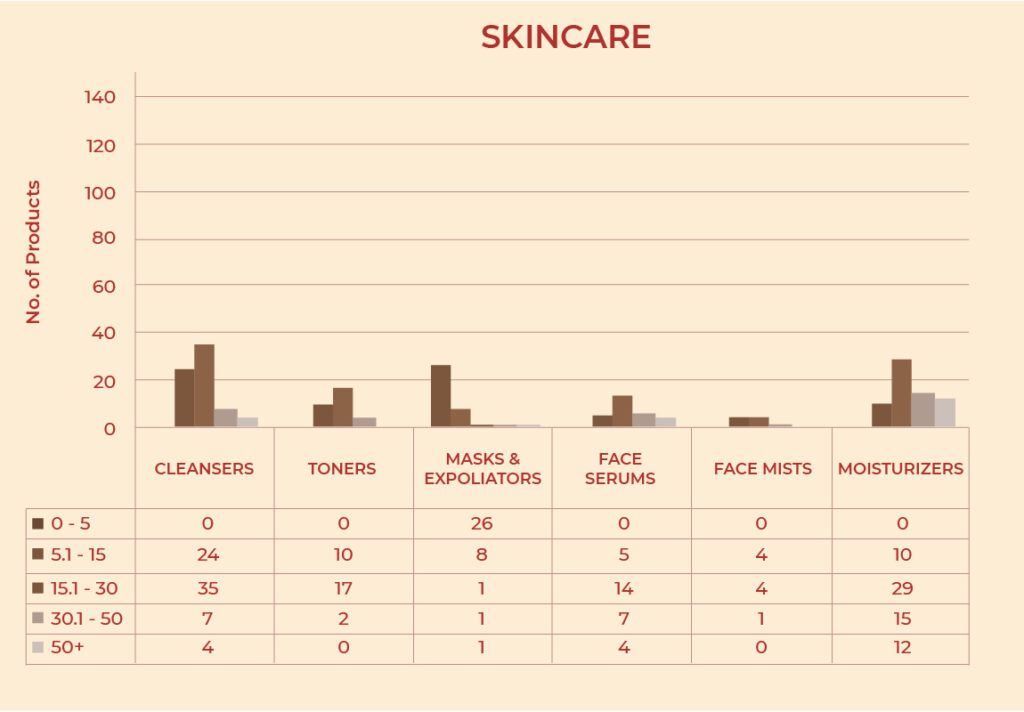

The product-price distribution map presents a detailed view of competitors’ pricing points across the product mix. The visual below is a representation of the pricing ranges of different product types offered by a group of direct competitors dealing in skincare products.

Pic 3a:

In the chart above, it does not matter who the competitor is. What is important here is to comprehend the collective pricing tendencies of the competitors. It throws light on how different product types are currently priced and offered in the market. For example, in the chart above, it can be seen that a majority of cleanser product types are in the price range of USD 5 to USD 30. If a new brand believes that it can charge higher than this, it needs to take into consideration the quality of the product to be offered, brand perception, competitors’ UVP in the higher price ranges, advertising and promotional efforts required, etc. If a brand enters

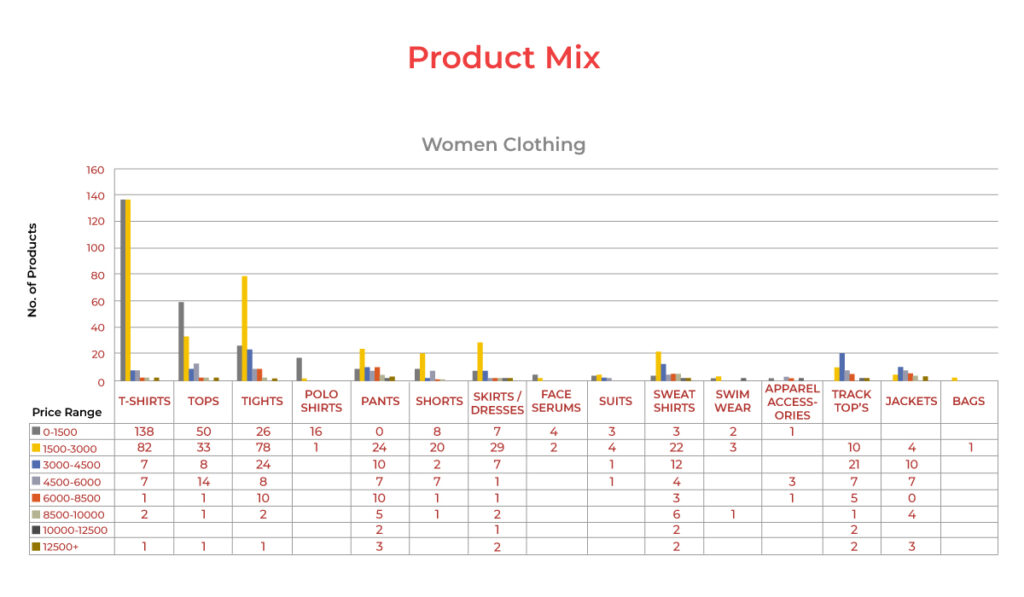

A snapshot of a similar nature from a research carried out by YRC is shown below. The visual in Pic: 3b shows the product-price distribution of Adidas in the women’s clothing category in a particular country.

Pic 3b:

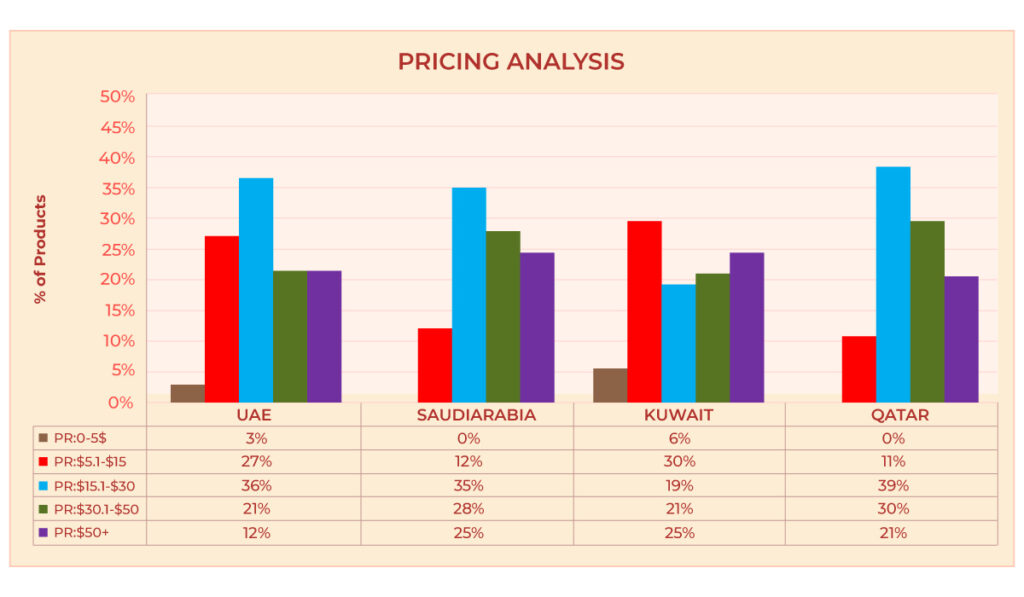

Pricing Analysis Vis-à-vis Different Regions

Analysis of competitors’ price ranges across the product mix in different regions helps in determining the popular price bands in these regions. Determining the popularity and focus areas of competitors in terms of price bands provides direct hints for better merchandising and pricing strategies. It speeds up the decision-making process. These popular price bands should interest new eCommerce players because a majority of product types are offered by competitors within these bands. To better understand this, take a look at the visual below.

Pic 4:

The graph shows the price analysis of a group of direct competitors in the beauty products sector in four countries. The offerings are very limited in the entry-level price range among all the players. Entry-level products may not find a big market in these countries. The price band of (USD 15 to USD 30) is a high-focus area in all four countries. Barring Kuwait, all the players have the majority of SKUs in this price band. It need not necessarily bring the most of the revenue but this band attracts the majority of customers. If you are a premium brand, you would like to consider Saudi Arabia and Kuwait first because the other players have a relatively greater product presence in the premium price band in these two countries.

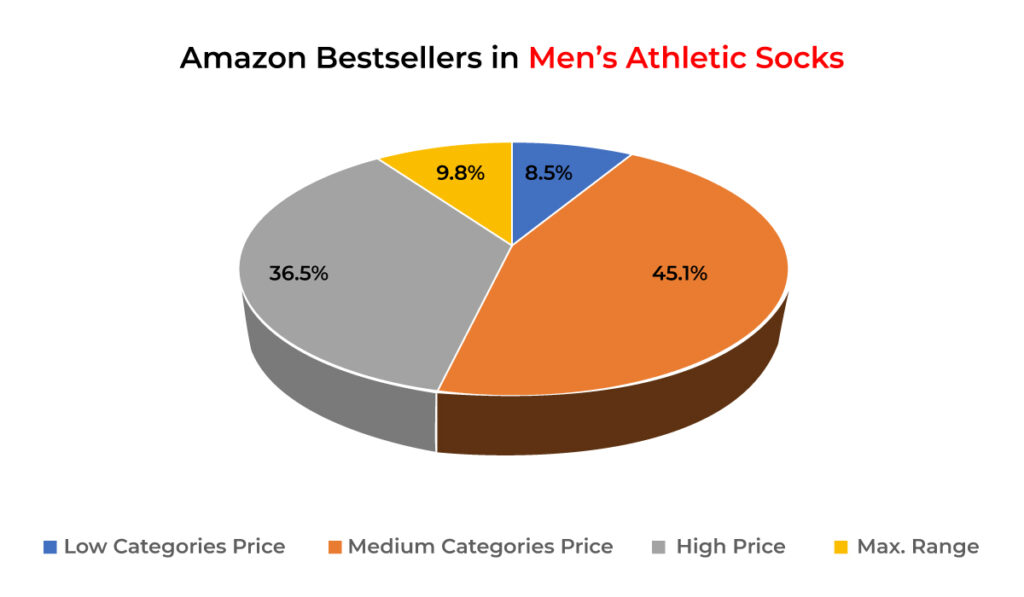

Price Band Performance

The performance of pricing strategies is eventually reflected in whether the business goals have been achieved or not. Sales volume is one of the most important parameters to judge the effectiveness of pricing strategies. Given below is a visual of the performance of various price bands in the product category of men’s athletic socks on an online marketplace platform for a selected period in a few selected markets.

Pic 5:

The graph clearly shows that the medium price band is a winner. But there is also a big market for the high-price segment of socks. The bestsellers in the entry-level and premium band are relatively fewer in number. What can be concluded from this? Let us provide one insight. If you are a premium brand, by lowering your prices to the high price band, you could be selling more in the given market. Of course, there are costing factors involved. But if your products are entry-level, you may not have the entire sea to you. You could push your products into the mid-price segment but that would entail some product development and extra efforts in digital marketing. Whatever the conclusion or the pricing strategy, having this data in the first place is important.

It becomes easier to understand how sensitive pricing can be when we think of it as customers. If a product of the same or similar value is available at a lesser price, there is no reason to not go for it. But this perspective does not work when we think on the macro scale involving the entire product mix offered by a host of direct competitors in one or more market regions. There, we need research-driven data and information using the right eCommerce market research tools and methodologies. Then there are bigger business goals and objectives involved. Relevant and expert statistical and strategic insights are necessary to formulate the right pricing strategy in eCommerce that is aligned with these goals and objectives.

Found this blog worth Reading?

If you liked this blog, please visit our blog section and YouTube channel for regular updates and insights on the retail and eCommerce industry.

Get In Touch