Business Plan Writing Services

Business Plan Consulting

The process roadmap of the business, a business plan’s core objective is to identify and analyze an existing business or opportunity by examining its techno-economic and financial feasibility. Business plan consulting services are essential to keep the business on the right track, helping it to achieve its strategic goals and objectives through expert advice. Under this, external third-party consultants offer strategic, customized advice based on business influencing factors and the type of business. Thus, for a business plan for startup vis-à-vis an established international business, this advice will vary.

Our Expertise:

Based out of India, Your Retail Coach (YRC) is a retail consulting and outsourcing company offering a wide range of business plan consulting services tailored to suit every business need. We have proven industry expertise in new venture planning, business plan development, business plan market analysis, and professional business plan writing services. Here are some of the key types of business plans we help create:

Startup Business Plan

A business plan for startup is different from business plan development for an established MNC. A start-up is essentially a new business operating out of a shoestring budget. According to the Department for Promotion of Industry and Internal Trade (DPIIT), a start-up is defined as a business that has been established recently and has not covered more than ten years from its date of inception. New venture planning covers the following activities:

- Business plan writing service for the startup

- Developing the goals of the start-up business

- Choosing the form of entity which has to be incorporated for the startup

- Budgetary Analysis for the startup

- Regulatory compliance with respective authorities for the start-up

- Risk Framework and Mitigation for the startup

- Monitoring the startup’s activities after inception

- SME Business Plan

- Large Enterprise Business Plan

SME Business Plan

An abbreviation for Small and Medium Enterprises, SMEs are businesses that have been in operating for a few years. Business plan consulting services for an SME consist of:

- Creating and shaping the SME’s business action plan and objectives

- Strategic advice on a crisis scenario

- Funding options for the SME

- Advice on regulatory compliance

Large Enterprise Business Plan

According to OECD, SMEs employ less than 250 people, while large enterprises employ 250 people or more. Large enterprises could be multinational corporates, which produce or sell goods or services in different countries, with their operations centrally controlled by the parent company. For large enterprises, business plans focus on:

- Refining business strategies

- Continuation of Business Planning

- Diversification of services and new products

- Expansion opportunities, setting up business footprints in various geographies

Vertical Specialization

Vertical specialization is a focus on niche domains or industry segments, for example, Retail, Finance, or Healthcare. This makes business development easier on both sides, since specialization helps to build better project plan management workflows, win more clients, and have relatable industry-specific success stories. For vertical specialization, we have to analyze criteria like how lucrative the vertical is, whether it has growth potential, structural stability (i.e. the decision-making processes, regulatory environment, etc.), competitive advantage, etc. Business consultants and clients have to consider the following factors for vertical specialization:

- Specializing in multiple areas

- What to look for in a client industry vertical

- Common areas to specialize

- Breaking into a new industry

- Expanding into similar industries

- Scope for agency specialization

- Is the market large enough to handle vertical and horizontal specialization?

Retail Business Plan

A retail business plan is a structured, written document that outlines important information about a retail business. The culmination of a brainstorming process ensuring realistic goals, it is a roadmap enumerating the nature of the retail business and its growth plans. The following are the key elements of a retail business plan:

- Executive Summary (pilot blueprint and areas of potential interest in the intended business idea)

- Business Analysis

- Marketing Strategy

- Products & Services

- Management Plan

- Financial Plan

E-commerce Business Plan

According to 99Firms’ Ecommerce estimates for 2020, the e-commerce market is booming currently, with more than 95% of all purchases expected to be online by 2040. Here are 9 key steps to prepare a comprehensive retail and e-commerce business plan:

- Products: Description of the items, including inventory and packaging

- Market Analysis: Analysis of the market environment including competitors

- Strategy & Implementation: Sales forecasts and customer acquisition strategy

- Marketing Strategy: Mission, branding, and customer communication

- Web Plan: All website development requirements

- Management Summary: Employee requirements, responsibilities, and costs involved

- Financial Plan: Budgeting, projected profit & loss, cash flow, and funding

- Exit Plan: Strategic plan (with timelines) to sell company ownership to investors or other companies

Methodology:

Business Plan Methodology is a step-by-step framework to create a business plan that optimizes the use of an organization’s resources and helps in achieving its objectives. The methodology consists of structured phases as given below, all of which address critical components of the project plan:

1) Identify business goals, objectives, and vision

The company profile or snapshot is a key statement about its business goals, identity, objectives, and vision. Analyzing and decoding it is the first step towards creating an effective business plan. Two important modules of a company profile are its mission statement (i.e. its reason for existence, mission, culture, value, direction, and ethics) and elevator pitch (which outlines the company’s general-purpose and objectives). The company profile also includes basic company information which sheds light on its identity. This consists of the date of incorporation, business type, location(s), annual revenues, names and bios of founders / key leaders, and its employees. It can also contain product / service-offering descriptions, company history, recent important activities & press releases, and a summary of core business objectives.

2) Evaluate Business Resources (Human, Financial, Infra, etc.)

Assessing business resources like human resources, finance, infrastructure, marketing, etc. is vital for creating a successful business plan. All these departments require fast, flexible planning and analysis through integrated business planning initiatives. This could consist of a SWOT (Strength, Weakness, Opportunities, and Threat) Analysis and a Marketing Mix Analysis, along with other business planning models depending on the industry and the organization’s stage of maturity. The following chart shows the detailed business planning methodologies adopted for each of these business units:

3) Evaluate Business Resources (Human, Financial, Infra, etc.)

This reputed consultancy assists organizations in the FMCG to leverage their brand value and build their business by ensuring campaigns, trade activities and sales systems are streamlined for maximum efficiency with the help of standard operating procedure for retail stores. Retail Operations Consultant, YRC, ensures strong reporting systems and retail process manuals are in place to help your FMCG business expand by monitoring the “Business 3-s” i.e. staff, stock and sales.

4) Industry Evaluation (Market, Competitors)

This consists of an investigation, study, and analysis of the industry and market in which the firm plans to sell its products or services. The main goal of industry evaluation is to define the state of the industry based on various parameters and decide its business appeal for current and future needs. The extent to which the market’s ever-changing opportunities and threats can align with the organization’s strengths and weaknesses is also suitably analyzed.

A typical business plan market analysis focuses on industry size, segments, growth, profitability, cost structure, distributional channels, and trends. It then seeks to draw up the target market (with market segments) and the list of competitors, and help identify the unique strategic positioning and competitive advantage for the business firm. It also serves as the foundation for determining the crucial Marketing, Sales, Business Development, and partnership game plan, and help to define the company’s operational management plan under the Marketing and Sales policy guidelines.

5) Brand Positioning Analysis (Target Customer, Product Pricing, Brand Positioning)

Brand positioning analysis consists of a positioning or brand strategy, or a brand positioning statement keeping the target customer in mind. This involves optimizing market penetration and leading a market niche (or niches) for a brand, product, or service using strategies like product features, product pricing, promotion techniques, distribution, packaging, and competition. The end objective here is to create a USP (Unique Selling Proposition) for the brand, differentiating it from other competing products. The creation of an effective competitive advantage and brand positioning strategy is dependent on a detailed market and industry analysis.

6) Financial Plan (Capital Investment, Operating Costs, Breakeven analysis, ROI, five years forecasting, budgeting across all functions)

The Finance Business Plan is a statement of the business’s current financials, historical financial performance, its projected financial position in future factoring in business growth, investor consolidation strategy, and the exit strategy. It helps to calculate the business model’s financial feasibility and consists of four standard financial statements (Income statement, Balance Sheet, Statement of Cash Flows and Statement of Owners Equity), P & L statements, and Revenue and Expenses numbers and forecasts. The Revenue and Expense projections include short-term forecasts (1 year), medium-term estimates (3 – 5 years), and long-term estimates (6 – 10+ years). The Investor strategy is a plan to set up business valuation and attracting investment capital in return for company ownership. The key components of a finance business plan are:

- Capital investment

- Operating costs and expenditure

- Profit and loss statement

- Cash flow statement

- Balance sheet

- Income statement

- Business ratios and Break-even analysis

- Working Capital management

- Planning and Budgeting

7) Critical Pathway (Business Operations & Implementation plan until business launch)

Before a business launch, the Business Operations and Implementation Plan defines the who, what, where, and how of the product/service offering. It is an elaboration of all processes and systems in place to produce, store, deliver, and support the product or service offering. Elements covered in this plan include the following:

- Firm Infrastructure / HR / Management structure

- Determine the Legal Business structure

- Technology Development/R & D Process

- Design Process

- Sales forecast

- Personnel plan

- Production / Manufacturing Process

- Value Chain Relationships (Procurement, Suppliers, Partnerships, etc.)

- Inbound / Outbound Logistics

- Inventory Process

- Insurance Policy for the business

- Distribution Process

- Customer Training and Product Support Process

- Customer Service Process / Policies

- Internal Controls

- IT Infrastructure – Hardware & Software setup

- Management Systems (Sigma Six, etc.)

- Continuous Process improvement or Operational Efficiency

8) Business Pre-Launch Plan (Pre-launch planning related to Marketing, HR, Operations & Sales)

Business Pre-launch planning related to Marketing, HR, Operations, and Sales is very crucial and ensures that all items are in place. The following action items are necessary before the business launch:

- Define the business staffing needs and job descriptions for employees

- Post advertisements, take interviews and hire employees

- Build the team according to skills and expertise

- Set up the technology infrastructure, including the software and hardware roadmap of the business

- Establish Point of sale (POS), Accounts, CRM, Billing, and Payment systems

- Development, preparation, and implementation of the go-to-market plan

- Marketing team’s unique value proposition, user and buyer personas, alignment with the competitive landscape, etc.

- Pre-Marketing Plan – Creation of a logo, brand tagline, website, email, and social media campaigns, co-branding and advertising, both for pre-launch and post-launch

- The entire organization, i.e. executives, marketing, sales, customer support, operations, development, manufacturing, accounting, HR, compliance, etc. ready to handle questions or requests from customers and the general public on the launch

- A compelling PR campaign/machinery in place, the launch date communicated to all relevant people, and readiness for a Press Release for all media outlets

- Goals and operational roadmap for the product launch, ready and shared with stakeholders

9) Post-launch strategy (Business Strategy & Operations planning for initial 01 year, after business launch)

Post-launch strategy is as vital as its pre-launch counterpart. Business strategy & operational management plan for the initial one year after the launch should consist of the following:

- Building a robust and solid supply chain, logistics, and distribution network: Businesses should take stock of their inventory and ensure adequate supply to meet demand. This can be achieved by creating a solid supply chain, working closely with vendors, and aligning their maximum capacity and production & distribution scaling capacity in case demand levels fall.

- Post-launch marketing activities: Continuation of sustained advertising and branding to build a business reputation, networking with bloggers, journalists, and industry influencers

- Test and optimize promotional campaigns: Continue to reach out to PR agencies and media, incorporate consumer feedback in real-time. Continuous testing is invaluable in learning, shaping strategy, optimizing execution, and remaining agile to evolving business needs.

- Sales and Marketing functions are in sync: Aligning sales and marketing is a challenge for many businesses. Both groups need to have a common understanding and agreement on the shared goals, strategies, and success metrics for the organization through transparent communication at all times.

- Transparent, closed-loop reporting process for all units: This consists of keeping all stakeholders on the same page by using data to highlight which messages and activities from Marketing, HR, Finance, Sales, Operations, etc. are yielding the best overall results, and vice-versa, i.e. which actions need corrective measures.

Business Plan Key Inclusions:

From a financial perspective, the following are the key inclusions in a typical business plan:

Model Feasibility & Workability Analysis

This takes all the relevant factors of the project plan into consideration, i.e. the economic, technical, legal, and scheduling factors to analyze and determine the probability of completing the venture successfully. Program managers and investors use feasibility and workability studies to ascertain their pros and cons before they invest time and money into it. Two key financial metrics of feasibility analysis is NPV (Net present value) and IRR. NPV is the difference between the present value of cash inflows and cash outflows over a time period. IRR is used to calculate the profitability of potential investments and is the rate of return where the project’s NPV becomes zero. A project is feasible if the IRR is high and is greater than your interest borrowing rate.

Capital Investment

Capital investment means having sufficient reserves of cash, loans, or assets to fund business operations. Investment size and the reasons for capital investment can vary from one business to another. This includes a proper assessment of capital requirements, sources of capital (Example: Banks, investors, financial institutions, angel investors and venture capitalists), capital structuring and restructuring, cost of capital, terms of repayment, etc.

Operating expense (One Time & Recurring)

One time or non-recurring operating expenses are extraordinary expenses like mergers & acquisitions, real estate and equipment purchases, large-scale facility upgrades, severance pay costs due to workforce reduction, or repair costs after a sudden natural disaster or calamity. Recurring or normal, ongoing expenses are incurred during a company’s routine business operations and are factored into the income statement as indirect costs, as also into its balance sheet and cash flow statements. Examples include general and administrative expenses like salaries and wages, R&D costs, marketing expenses, travel, and related expenses, IT expenses, and depreciation that may apply to property, equipment, or other company assets over a longer time frame.

Cost Sheet

A cost sheet is a report showing a breakdown of total costs by business component, i.e. material, labor, overheads, etc. associated with a product or service. Key benefits for cost sheets are that it helps to determine the total cost and the cost per unit produced, comparing and calculating business margins, and possible selling prices for these products or services.

Revenue Projection for 3 years

Revenue projections can be defined as the estimated money a business is expected to make during a specific time frame, i.e. 3 years in this case. These revenue projections can often be classified as monthly, quarterly, or annual accounting periods. They can be ideally done using a mix of conservative and aggressive case scenarios. For example, an aggressive revenue estimate might assume a low price point for the base product, and a higher price for the premium product, three to four marketing channels, one new product or service launched in the first year, and five more products or services introduced in each business segment in years 2 and 3. A time period of three years is normally used for revenue projections because it is significantly long enough for an insight into the business. However, longer revenue projections are sometimes inaccurate because of rapidly changing business needs, and constant transformation of technology, marketing, economic, financial, and overall customer experience landscape.

Breakeven Analysis

Break-even analysis is the sales revenue levels required for a business to cover basic costs and stay afloat, i.e. operate without making a profit or loss. The viability of any business depends upon staying above this break-even number. The method to calculate this is: Break-Even point (units) = Fixed Costs ÷ (Sales price per unit – Variable costs per unit) or in Sales INR using the formula: Break-Even point (Sales INR) = Fixed Costs ÷ Contribution Margin.

Payback Period

The payback period metrics refer to the time taken to recover investment costs, or in other words, it is the time needed for an investment to reach its break-even point. An investment’s attractiveness quotient is directly associated with its payback period, i.e. shorter paybacks mean more appealing investments. While payback period calculations are useful for finance business plan and capital budgeting, it can also be used by businesses to calculate returns on energy-efficient technologies, including maintenance and upgrades.

Margin Calculations

Margin analysis or calculations is a crucial tool to understand business profitability. It provides a strategic insight into how successful the business is in generating and retaining money and is a measure of the company’s earnings (or profits) compared to its revenues. Profit margins shown in proportion to sales is a key financial objective for business planning. If a company focuses on sales growth but also incurs high marketing and administrative costs, then profits margins and cash flow will be squeezed. Therefore, establishing clear cut profit margin strategies makes it imperative for businesses to drive and sustain revenues, at the same time trying to keep costs firmly in check.

Profitability Calculations (Gross & Net Profit)

Gross Profit Margin for a business is the percentage of revenue that surpasses the COGS (Cost of Goods Sold). A higher gross profit margin indicates that a company is profitable, over and above its actual expenses. The net profit margin % on the other hand estimates how much of each rupee of revenue gets converted into actual profit. An increase in revenues does not necessarily mean increased profitability. Net profit is the gross profit (revenue subtracting COGS), subtracting operating costs, and all other expenses like taxes and interest paid on debt.

Customer Metrics (Walk-ins, Basket Size, etc.)

Walk-ins/footfall and basket size are key revenue-side customer metrics measuring the profitability and overall financial health of retail businesses. Tracking store walk-ins and footfalls provide a real-time picture of items that are generating revenue and the ones which need improvement. They are dependent on factors like shopping seasons, a new store location, a new display window design, or a recently launched loyalty program. An important retail metric, average basket size refers to the number of items purchased in a single transaction and is measured by total units sold ÷ number of invoices. Knowing about basket size and pbasket diversityp (which is the total number of categories shopped) helps to drive walk-ins and footfalls, thereby leading to increased consumer spending.

ROI

Return on investment or ROI is a key performance indicator (KPI) to determine the profitability of an expenditure. When calculating ROI, it’s important to consider less obvious factors like time, hidden costs and fees, or even emotional components like stress and pressure. Investors can quickly check on investment prospects, as well as potential returns on various investments by computing the ROI, thereby saving precious time and money. It can be calculated as:

ROI = Profit/Investment, i.e. Net Profit/Total Assets.

Profit & Loss Statement (03 Years)

The profit and loss (P&L) statement is a financial statement that shows the details of company earnings, costs, and expenditure incurred during a specified period – 3 years in this case (which provides a balanced medium-term perspective). Along with the balance sheet and the cash flow statement, the balance sheet is published quarterly and annually by every public limited company. Banks, investors, and customers can get a true picture of the business’s total income, debt load, and financial stability from these P&L statements.

Budget Allocation for every activity in the organization (Human Resources, Marketing, Operations, IT)

Budget allocation is the quantum of finances earmarked for each activity or department, i.e. Human Resources, Marketing, Operations, IT, etc. It lays down the maximum amount of money an organization is willing to spend on a given item for a department, with limits set for each. Budgetary analysis is one of the key components of pbusiness plan consulting servicesp. A budget is, therefore, a key business planning exercise which helps to:

- Control finances efficiently

- Allocate optimal resources on projects

- Ensure continuous funding for current commitments

- Facilitate confident financial decisions and meet objectives

- Ensure enough money for all future projects

- Identify problems before they occur (Example: Raising finance or cash flow challenges)

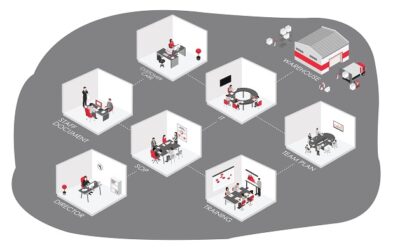

The following chart summarizes the role played by a business planning consultant:

Thus, a Business Plan is continually evolving, being regularly refined through regular periodic updates to suit changing business, customer, and market needs.

Professional business plan writing services from YRC

At Your Retail coach (YRC), we do recognize your business needs. Mentoring and guiding you every step of the way, we follow a focused approach to create your customized business plan.

Initially, we discuss with you to understand your exact business needs and requirements, ensuring that we tailor our expert advice for your business. We require specific documents and information about your business during our initial meeting. Our team of professionals would then review the following information:

- Financials

- Any drafts, thoughts, and ideas from you concerning the business plan

- Any other information which will help in creating and implementing the business plan

After this initial discussion, we decide upon the terms of engagement, and then start preparing the business plan. The draft plan contains the following information:

- Business Introduction

- Executive Summary

- Info on Business Products

- Financial Projections

- Final Business Plan

Our business plan writing service has been conceptualized keeping your business in mind, to enable you to craft your success story. Changes and edits are made to the plan wherever necessary to ensure proper and optimal business plan development. To tap into exciting, new growth opportunities, and be a step ahead of your competitors, get in touch with YRC today and unlock the true potential of your business.

Get Advice for Business Plan Writing Services

Related Blogs

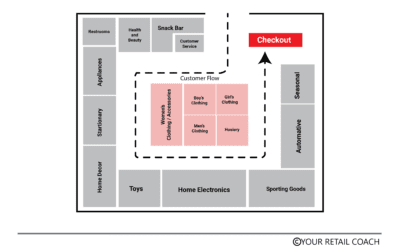

Retail Store Layout Strategy: What to Consider and How to Plan

Why Store Layout Matters in Retail The layout of a retail store carries several internal and external business implications. Layout is an important physical aspect of branding efforts. It creates an opportunity to create the desired atmosphere in stores thereby...

Reliance Gourmet Supermarket – “Freshpik” Case Study

The fifth-largest and preferred retail destination globally, the Indian retail industry is one of the fastest-growing segments in the world. India is experiencing unprecedented growth with retail development taking place not just in major cities and metros, but also...

How to Organize & Grow Supermarket / Hypermarket

Already running a supermarket store and wondering how to scale it further? Are you contemplating what should be your next steps to accomplish your vision to organize and manage multiple stores? If this is what you are looking for, then you are in the right place. Your...

We work only for Visionaries.