Retail site planning is no longer driven by gut instincts and gut feelings. With more competition and rising costs leading to higher margins, brands are looking to data-driven methods to identify proposed store locations that maximized returns. When you are considering your first store to new markets, a plan of action strategically behind data for assessing store locations can help a retailer with growth potential.

Brands today in a digital age need sophisticated analytics and market decision support when developing market entry plans for new or emerging geographies as these market-entry strategies would require significantly more resources when compared to existing markets. The best way for businesses to reduce their risk to investment with new market entry plans is to have a strategic roadmap for entering new markets with proper analytics and market intelligence in real-time and seek to reduce the capital commitment while maximizing sales attraction, maximizing foot traffic, and maximizing anticipated brand equity.

For retailers assessing entry into an emerging region such as Africa and the Middle East we have to understand local consumers behaviour, local infrastructure, consumer trends, and socio-economic indicators. This, we believe, is where better data can create the achievable difference, the ability to create actionable insight from the best data collected to ensure that every potential site meets required expectations.

Why Data is Crucial in Market Entry Strategy

When companies enter unfamiliar markets, such as Africa and/or the Middle East, they are met with opportunity and uncertainty. A market entry strategy based on data can help minimize the uncertainty present in new, complex, and volatile markets when addressing the most fundamental market entry questions: Where’s the demand? What’s the level of purchasing power? Who are the competitors?

Retailers use advanced analytics tools to quickly analyze demographic distributions and competitive landscapes to ensure they are strategically-positioned to satisfy consumer demand in those places that enabled consumers to access and localize products that meet their needs. Retailers will identify and locate underserved markets by using big data analytic techniques to discern when areas of the affordably growing middle class begin to emerge in select African or other Middle East cities, whereas the need for other types of retail may be constant in affluent neighborhoods in the Middle East.

Insights derived from data analytics will enable retail development strategy for growth, and ensure that each investment into atlantic sourcing infrastructure, human capital, and marketing highly aligns to your state’s clear business goals. Data based demand analytics will ensure your brands do not over-invest in developing retail in hot spots or oversaturated zones; as well can maximize the retailer’s emergent state that anticipates the steadily shifting foibles of the local population who adapted to other forms of consumption. Retaining data allows to largely create a data framework to enable a spectrum of ideal launch metrics.

Identifying High-Potential New Store Locations

Data helps retailers narrow down new store locations that are more likely to deliver sustainable long-term value. This consists of evaluating neighborhoods based on demographic statistics, income segments, footfall patterns, and customer behavioral tendencies.

In Africa and the Middle East, where market maturity can vary significantly from city to city, precision is critical. Lots of retailers will target cities with a high proportion of youth, increasing smartphone penetration or emerging retail market infrastructure. Data from mobile location tracking, surveys and social media sentiment analysis can give clues about what customers expect, and what they feel about the brand/store.

Completely analysing the competition will also play a key role. Retailers can choose to open in areas where there is less saturation in a particular type of store brand, or where they can show how their store experience is different to their competitors, and that they provide a unique experience for their customers. This will limit cannibalisation, and make sure every store contributes value within the overall retail rollout.

Smart Site Selection Balancing Opportunity and Risk

Effective site selection is any combination of goodness and practicality. An area may demonstrate strong demand, but issues in access and high lease costs can negate profitability. Appropriate data serves to make the good and practical characteristics find equilibrium.

Retailers track metrics like walkability, access to public transit, availability of parking, density of local businesses, and so on, they use heat maps, geographic information systems (GIS), and customer information. The process is done in a way to use opportunity as well as risk in the decision making.

Disparities in infrastructure between places in Africa and the Middle East means it can be even more critical. Figuring out a retail location may also begin moving near retail, but where power supply is inconsistent and warehousing support is non-existent. Selecting an expansion site with logistical data that eventually feeds the road map can ensure you don’t make an avoidable mistake and open better performing units the day they open.

Building a Scalable Retail Rollout Plan

Once a successful selection of sites is made, it is time to scale-up. A retail rollout plan that is established using the considered application of predictive analytics should be able to deliver the best sequence and timing for opening stores.

This includes considering the amount of capital needed, operational stability, the availability of local staffing, and the amount of time needed for effective promotional/marketing efforts. Brands can compare the performance of previous stores or use market simulation effectiveness to drive a predicted ROI from new stores. This provides the space for brands to pace their evolution that is, undertake strategic scales- for example: the ability to penetrate core urban areas first, and then make headway into secondary cities as the quality of necessary infrastructure allows.

Defining and creating scalability is important. Strategies for rollout should be fluid to adjust; for example, revisions to rollout are important in relation to new data (factors), economic indicators, or changing expectations from consumers. A modular rollout structure also ensures that scaling up, or down, based on results can occur without too much loss of momentum.

Optimizing for Market Penetration and Geographic Expansion

There’s no stopping data-backed systems at launch time. For brands to sustain success, focus should be on market penetration, mostly measured as increasing share in that existing market, and at the same time be preparing for geographical expansion into new territories altogether.

Retailers are cheering as they are constantly assessing performance of stores, local promotions, customers’ reactions and behaviours, and the movements of competitors’ plans in real-time.

All of which means that they are able to continually refine the store format, create new services or styles,, adjust their promotional messages.

An example of this might be to see success in a Nairobi store, showing positive revenue, but also indicates demand in urban centres where they might expand into other neighbouring cities. Or spending lots of investment into Dubai’s waterfront simply to conclude that its future success lands in Abu Dhabi or Doha. The point being, an evidence-based decision-making approach ensures that, when moving on the roadmap of the expansion strategy, you know that each point will probably land and be profitable.

Data-Driven Expansion Roadmap

Retailers need to go beyond instinct and create a more substantial expansion roadmap, based on insights, in today’s fast-changing environment. A data-driven approach will lead to better choices for site selection, new store locations, and rollout, and improves ROI.

As retail continues to expand into Africa and the Middle East, the need to understand cultural, economic, and geographic context is even more critical. By combining demographic study, reviewing competitive landscape, and implementing predictive tools, brands can make sure each store will be positioned as a key growth engine.

In the end, data offers retailers greater confidence in expanding, new markets, new customer loyalty, and a way to scale efficiently. With the appropriate tech stack and rigorous analytics, a retailer’s market entry strategies can become a critical part of the long-term success of a retailer.

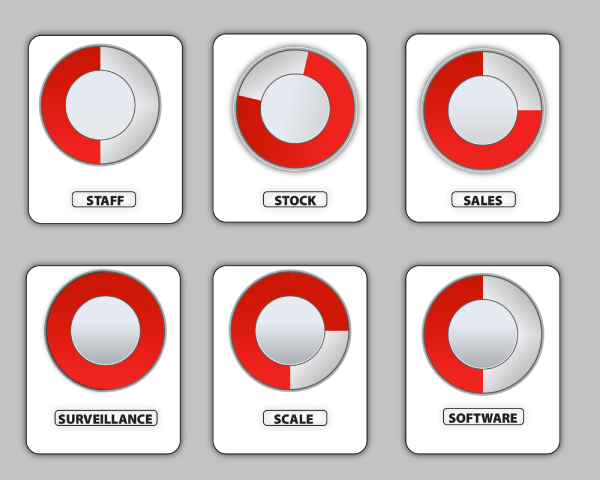

Retail Healthometer

Check the health of your business? Are you ready to organize & scale ?