Feasibility to expand retail is more than just picking a location for a new store. It is a multi-metric analysis of viability, sustainability and profitability for the long-haul. As brands grow professionally, and particularly across international borders, the exposure increases. Opening a new store without assessing the significant metrics could lead to operational inefficiencies and lost investment funds.

Retailers, in today’s climate, need an expansion strategy driven by data that explicitly applies detailed studies of market penetration, demographic studies, competitor benchmarking studies, and so on. It is important that an expansion decision takes into account the goals of the business and position the company within the brand in order to be successful in the new region.

Even in saturated or emergent regions in Africa or the Middle East, feasibility studies are even more essential to be cognisant of customer uniquely differentiated behaviours, infrastructure, and regulatory guidelines. It is critical to identify risks, potential customer demand, and the readiness of the supply chain prior to advancing into growth.

Feasibility studies are the foundations of the retail growth strategy, helping to mitigate risk, maximize capital, and prepare for sustainable growth. Let’s jump into some of the metrics we feel are most important in making good retail expansion decisions.

Defining Your Market Entry Strategy

An effective market entry strategy is fundamentally important to the early success as you expand as a retailer. Regardless of whether you are entering internationally or entering new regional territories, your entry strategy defines how you will enter and position yourself in the marketplace.

Market entry strategies can vary, from full ownership by the retailer, such as direct investment, to ways you may enter through franchising, joint venture models or e-commerce led models. Your choice of entry strategy is unique to the retailer’s capabilities, risk appetite and consumable knowledge. The retailer will want to not only understand consumer buying behaviours and levels of brand awareness but should also have a firm understanding of legal and supply chain aspects they need to consider in the new territory.

Retailers can benefit from looking at demographics and customer segments to help shape their market entry strategy. In international markets like Africa and the Middle East for example, retailers need to consider market entry methods specific to cultural adaptations, price points and brand messaging.

In addition,data points from a market entry will help define operational capacities like start-up costs and marketing budgets. In addition to traditional supply chain dimensions, thought must be given to import/export regulations, taxes and possible distribution networks or not depending on your pipeline model. The best dispensing, formulation aide, for hospitals is the knowledge that market entry strategies to path needed operationalities are framed within the long-term retail roll out plan for market entry to smooth your roll out, and action your consumer experience.

You will gain competitive advantage through locality in-market insight like gender factors, and/or understanding different levels of brand irrelevance.

Designing a Scalable Retail Rollout Plan

A retail rollout plan details your method to open stores over time. It lays out a phased process to launch stores; hire employees; prepare the supply chain; market activation; and post-launch support.

The most important thing is scalability, you pilot with a few stores, learn quickly and then roll-out, roll-out, roll out. Your rollout plan must align with training programs, operating systems; for example, inventory management, Point of Sale systems and local hiring strategies. There may be slight variations in the stores based on local demographics and competition in the market, so your plan must have enough flexibility to change the timing.

Technology enabled operations cloud based inventory systems, Customer Relationship Management (CRM) and so on, can support a consistent omni-channel experience across your various locations. It is important to set Key Performance Indicators (KPIs) for each store roll-out, including store profits, footfall, conversion rate, customer satisfaction, etc.

In markets such as Africa and the Middle East, rollout plans must read any political, economic volatility, and exposure to currency risk. Brands that have a well thought-out plan have been able to scale without losing control of their quality of product and performance.

Assessing the Competitive Landscape in Target Markets

Every plan to expand will also need assessment of the competitive landscape. Your competition, who are they, how big are they, how are they performing? What does the competitive landscape look like?

When considering Africa and the Middle East it is important to note that competition can be drastically different between countries and regions. Global brands dominate in some respects, but in other markets community local retailers may dominate.

With a solid understanding of the competitive landscape influencing the pricing you will charge, marketing strategies, and market entry strategy will be more effective.

Understanding Demographic Analysis for Expansion Success

Demographic studies give retailers the ability to align the products and services they provide to that target society. Age, gender, income, lifestyle, household size, and cultural norms will influence consumer behaviour, and therefore, the potential for expansion.

You will want to be sure to create detailed demographic personas using census and public (e.g. customer surveys) data, along with reports from third party research. In some markets, such as Africa and the Middle East, this would be even more important in light of the high number of ethnic differences, language variations, and the volatility caused by urban development.

Demographics can also be very helpful for site selection and retail rollout plans.

Retail Growth Strategy and Market Penetration Indicators

Your retail growth strategy should comprehensively address how you intend to grow, sell, and improve customer retention in new markets or existing ones. A strong strategy will take into consideration not just organic growth and synthetic growth, but growth via omnichannel as well as how those may impact operations.

While penetration ratio is an important metric because it defines how much of your target market you have penetrated relative to a total potential, be aware that low penetration ratio could signal opportunity while high penetration ratio will require more innovation to maintain.

You should look at a number of metrics: customer acquisition cost (CAC), lifetime value (LTV), market share, and basket size. Importantly, track your metrics against each location to determine what strategic changes and marketing mixes you can introduce or adapt.

You may also consider aggressive offers, loyalty programs, or localized products in highly competitive settings or when expanding into Africa and the Middle East, which would require you to think more strategically about your localized digital approach, mobile commerce, or go-to-market partnerships.

Ultimately, your retail growth strategy should not be articulated at the store count level, or simply pursue store count. Rather, it should prioritize: customer experience, operational standardization, and ROI metrics.

Evaluating New Store Locations with Site Selection Metrics

The selection of sites is one of the most important aspects of any retail expansion plan. Getting it wrong can stifle store performance, even when other areas of the retailer’s business are favourable. It is vital that your retailer can access local geographic and consumer data in detail.

Key metrics for site selection include pedestrian and vehicular traffic, accessibility, parking, competitive environment, population density, and average income. These metrics will have significant implications of visibility, operational expenses, and revenue opportunities, so brands must use geographic information systems (GIS) and heat maps to identify high-opportunity areas.

Alternatively, for global or regional expansions, retailers must also consider political stability, infrastructure, and zoning laws. In Africa and Middle East areas, urbanization rates and transport developments are impacting the planning of new store sites.

And last but not least, the alignment with neighbouring businesses, and fit with your brand positioning is critical. A luxury brand should consider their proximity to high-end malls or hotels, and value-based retailers should be thinking about high-density residential areas.

By using site selection analytical processes that base decision-making on data, retailers can reduce risk and build a healthy retail footprint in every new market they enter.

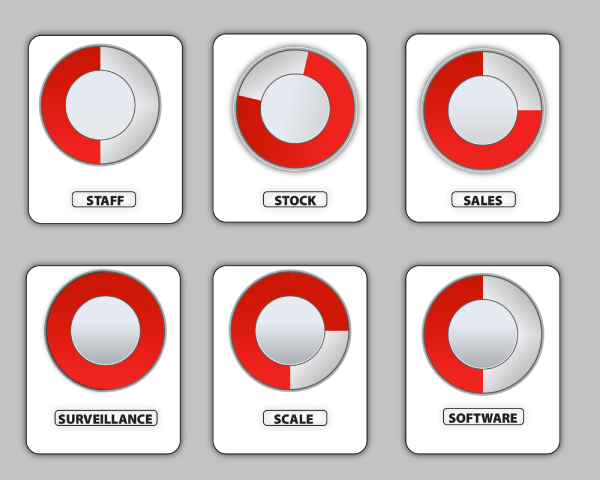

Retail Healthometer

Check the health of your business? Are you ready to organize & scale ?