A well-articulated go-to-market strategy is essential in any retail rollout. Your go-to-market strategy articulates how you plan to access your product/service and target customers, and how quickly you can realize growth of your business. Too often businesses stumble in their go-to-market strategy by failing to include an important part of the plan, resulting in improperly calculated, expensive mistakes or missed opportunities. Whether you are launching in a brand new geography or establishing a presence, your retail go-to-market strategy needs to be thoughtful and data-driven.

Collaborating with retail consultants, from the beginning, will ensure that there is alignment between your goals and executions throughout the beginning stages of your business. From retail site planning to feasibility for growth, there are important actions which will need to be planned for. This article explores in detail the most common mistakes brand make when implementing their GTM plan, as well as how to avoid them. If businesses take a strategic approach and listen to experts in retail growth advisory, they can mitigate risks and start to gain momentum from day one.

Mistake 1: Ignoring Local Retail Site Planning

Choosing a poor retail site can cost your business even with the best of all business models. One of the most common mistakes in go-to-market strategies can be site planning. Many retailers make decisions about sites based on gut feelings or anecdotal data and ignore the available data on location. If the site does not align according to visibility, traffic counts, population, demographics, or access, the store could see poor sales with high operating expenses.

Taking advantage of retail location intelligence can enhance the decision-making process around locations. It can direct you to prospective sites based on available consumer behaviors, traffic patterns, proximity of competitors, and average spending power in the local purchasing area.

Retail consultants leverage estimating, GIS mapping, and footfall analytics in their recommendations for locations. Avoid the trap of believing if one model site works it works everywhere. Each market should be treated independently, and you should work with experts to develop a Go-To-Market (GTM) framework for each location. Whether you are launching one store or growing your business model through franchise development, ensure that location planning is data rich, hyper-local, and strategic.

Mistake 2: Overlooking Expansion Feasibility Studies

Many retailers quickly enter new markets without thoroughly assessing the feasibility of expanding there. This assessment should include, at a minimum, evaluating local demand, evaluating infrastructure readiness, understanding cost structures, and evaluating legal constraints. There is a high risk of underperforming or closing down altogether if you do not engage in detailed feasibility studies.

Imagine, for example, a brand not factoring in the operational costs in a tier 1 cities project or underestimating the local spending habits in a small town. You can reduce your risks by working with retail consultants focused on strategic market entry. They will conduct an informed analysis of the economic factors, local trends, competition, and the infrastructure that can validate your market potential.

A comprehensive feasibility study can save you significant money, assist strategic decision making and assess your market in a realistic way to enable any chances of success. Remember, every market is different.

Mistake 3: Underestimating the Role of Retail Consultants

It is common for brands to think they can manage expansion themselves and deem external retail consultants unnecessary. This is a huge mistake, especially in the current multi-faceted retail landscape. A good consultant will have cross-industry expertise, the necessary tools, and experience that internal teams may not. They will help to align your go to market strategy with the realities of the marketplace, challenges, and also opportunities. External retail consultants will provide a 360° perspective on retail project management, strategic planning, benchmarking competition, in addition to planning, implementation, and operational enhancements.

While internal teams are also considering all of these factors, it can be extremely difficult to remain objective without the perspective of an independent party. For new market entries, multi-store roll outs, and additional geographic expansions, relying on retail consultants for their important insights can also be invaluable.

Retail consultants shouldn’t just be thought of as “external experts”, but rather, as a strategic & trusted partner for your retail expansion objectives. While it may require an upfront investment of your time & money to have the right consulting team in place at the beginning of your retail journey, it will pay off in terms of the long-term sustainability, loyalty of your customers, and operational efficiency.

Mistake 4: Misaligned Strategic Market Entry Timing

Even though you have the right brand and product, poor timing for a strategic entry into a market can destroy your GTM effectiveness. Some businesses go out too early without having created demand, while others miss the prime seasonal period altogether. Thus, understanding when to enter the market is as important as what you are offering. The timing of your market entry should reflect in-market conditions — such as the readiness of the market, competitive cycles, local holidays, and trends or socio-economic phenomena. Again, when working with retail growth advisory professionals, a business gets a data driven roadmap that will plan marketing, logistics and store openings in synchrony for an effective GTM.

For example, going out into the market in festive months may or may not be suitable for particular types of goods, like electronics, compared with fashion. Timing your go-to-market strategy with the market pulse increases your visibility and profitability. Timing should never be regarded as secondary; it can be your greatest competitive advantage or your greatest weakness.

Mistake 5: Lack of Retail Location Intelligence

Many brands use obsolete or generic data when scouting locations. If you lack retail location intelligence, you are essentially driving blind. Retail location intelligence provides real-time data including foot traffic, demographics, heat mapping, and customer journeys. The costs of opening a store in a bad location are significant: you may open in areas with low purchasing power or low brand affinity.

Using technology such as mobile data analytics, AI-based demand forecasting, and competitive landscape behavior is now providing sharper insights. Retail consultants routinely bundle location intelligence with retail site planning as they realize retail location intelligence is an essential pre-decision output. Whether you are opening flagship stores or kiosks or whether you are optimizing your capture area you need location insights to increase the revenue potential. Don’t hope, analyze. Retail location intelligence shouldn’t be a nice to have, it is mandatory for any brand with a serious GTM rollout.

Poor Store Network Optimization

Having too many stores too close together or in clusters that simply are not viable leads to cannibalization and inefficiencies in operations. Store network optimization is essential because it involves where to allocate resources, brand positioning, and customer groups. Stores that are poorly allocated will have overlap, cost inefficiencies, and ultimately an unclear brand experience. Using data and tools to analyze data from network gaps, demand heatmaps, and customer behaviors recommends the best possible number of stores and where to build them.

Regardless if you operate your stores directly or through franchise development, your network should be leveraged in ways that support both profitability and scalability. Retail growth advisory teams, like us, can advise on effectively optimizing networks based on balancing count, format, and geo-distribution. Smart networks outperform, cost less, and generate brand equity faster.

Mistake 7: Unstructured Franchise Development Models

Growth through franchising can be done very well—but only with a franchising development model that is structured and standardized. Many retailers are guilty of growing the brand without SOPS, onboarding program, and performance measures. The result is usually poor and inconsistent service, brand debilitation, chaotic operations, and unprepared franchise partners.

An effective franchise system is, elements of training, technology, quality checks, and strategies to localize products/services. Your merchandising team must confirm that franchising agreements, communication packages, and central monitoring systems are finalized or agreed prior to opening.

Accelerators and retail consultants also offer distinct, or bundled (turnkey), franchise advisory support to brands; this includes advice on building frameworks, and scaling that can and will produce compliance and brand loyalty. In the absence of a structured model, not only will franchises not perform well, they can impact your entire GTM strategy.

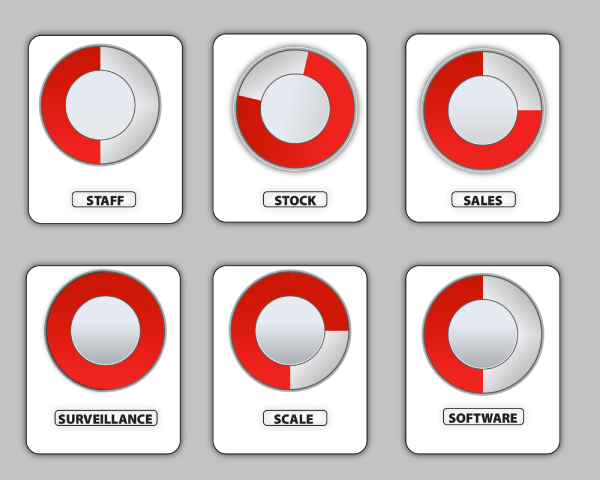

Retail Healthometer

Check the health of your business? Are you ready to organize & scale ?