Global retail expansion is all about entering a new international marketplace that requires a solid market entry strategy to alleviate risks and discover new sources of revenue. By not planning in fine detail, a new store can become a liability rather than an asset. As retailers plan on investing in other regions such as Africa and the Middle East, the considerations for market penetration and market expansion become very real.

By having a retail growth strategy and an actionable expansion roadmap, retail businesses can more effectively accelerate their global expansion plans. This article highlights how retail brands can partner with analytical expertise in strategic site selection, demographic analysis, and retail rollout strategy to improve their ability to penetrate foreign markets, while remaining profitable.

Understanding Market Entry Strategy

A market entry strategy, that is well-defined, serves as the basis for international retail expansion. Retailers can select both the entry model that they deem relevant to them depending on the predisposition of their market, their amount of money to stake, and their long-term intentions. With franchising being one of the lowest capital risks, the retailer gives up the ability to control the brand experience, where owning and operating each store gives the retailer complete control. Accordingly, when deciding to open or enter into a new operation, it is imperative to assess the demography, available regional supply chain logistics, and competitive conditions.

When expanding into Africa and the Middle East, companies must also assess the country’s political climate, import and export limitations, and the country’s licensing aspects. Each of these elements can be assessed and incorporated into an overall market entry strategy that allows a company to anticipate these market variables from day one and possibly most importantly, mitigate headaches and expense.

The strategy should also provide the ability to pivot. Addressing market entry variables include market penetration, store design, local recruitment/assumption of employment practices, and products or service categories should all mirror what local consumers expect. Cultural sensitivities and regional preferences should be taken into consideration, such that brands establish meaningful connections during their interactions with the new consumer base they are serving.

Selecting New Store Locations

The impact of location on the success of any retail outlet cannot be overstated. The location selection is not limited to just obtaining a well-located storefront. Location selection uses market data and demographic analysis, and takes into account commercial real estate valuation to help with locating areas of highest potential.

Most effective brands consider a mix of micro-level factors such as neighbourhood dynamics, and macro-level data such as economic forecasts and the location selection process. On top of how a retailer approaches a local market, they must be mindful of factors to align with necessary commercialization goals in a local market by ensuring they are able to scale up in new locations nearby, as demand increases like urban dwellers naturally do, in the local catchment area. Failing to select the right site can incur extra operational costs and lost profits within inconvenience of distance and time lost under certain procurement models, especially in those areas of the world where logistic challenges tend to be the highest. For this reason, provided that the basis for site selection is part of the broader retail rollout strategy, adding rigor to the site selection function, can control necessary logistics to optimize operational expenses to drive sustainable retail growth.

Crafting a Retail Growth Strategy

A retail growth strategy is more than simply opening a new store; it means developing a systematic and profitable retail portfolio over time. Retailers need to form growth plans that satisfy both rapid market entry and operational leverage. This will include some basic plans and thus clear objectives for the retailer, some forms of KPIs (sales / sq ft, customer retention) and some form of metrics that outline when the retailer has succeeded and when it has failed. For brands entering markets such as Africa and the Middle East, they will need to remain flexible and evolve their retail growth strategy based on local consumer insights and operational realities continuously.

Understanding what products to offer, pricing, how to design store layout, how to engage with customers, and having successful local partnerships (where possible through cooperatives, farmgate pricing, delivery mechanisms etc.) to ensure the least amount of risk is taken during the supply chain management part of the journey. Above all, creating consistency for the brand experience across any of your growth locations is key when developing a retail growth strategy.

Collaboration across indirect functions (sales and marketing), supply chain, human resources and operations is required to ensure your plan of action is consistent and unified across any potential expansion. If a retailer can develop retail growth strategies that span into larger business or expansion roadmap, it will allow for a more structured, systems-oriented approach to global market dominance.

Tactics for Market Penetration

Entering a new market involves far more than opening a shop; brands need to deploy strong market penetration strategies to get noticed, bring customers in, and develop a competitive edge.

Using methods, such as influencer partnerships, community engagement promotions and customized loyalty programs allows retailers to create emotional attachment with customers. Pricing strategies must also consider local economic conditions while reflecting a strong perceived value. Testing and understanding the competitive landscape is prudent to identify market differentiation opportunities and where possible avoiding head-to-head battles against established local competitors.

Planning Geographic Expansion

Geographic expansion can be an arduous task that requires rigorous planning when entering emerging markets. Retailers need to assess not only the risks associated with new geographies, but also the macroeconomic environment, urbanization, consumer spending habits, or even the state of infrastructure. In considering legal regulations and ease of doing business as well as the potential for political risk, retailers can minimize their overall risk.

Once the geography has been established, a phased entry will be critical. Retailers should focus on major metropolitan areas with higher levels of consumer purchasing power and greater demand, before looking into suburban and rural areas. Phased entry will help retailers allocate resources effectively, and establish their brands and market gradually. Factors such as supply chain resources, warehousing, and the appropriateness of transport use, from all components of the focused supply chain, are vital evaluation points in any new geography, as they also chart the destination of retail operations in any new geography.

Companies must incorporate assumptions about these resources as factors into their broader planning document for expansion. Geographic expansion plans should always complement a brand’s market entry strategy and retail growth ambitions. Expanding haphazardly can overload resources and create emptiness in dealing with growth plans.

Developing a Retail Rollout Plan

A retail rollout plan is a tactical tool that defines the operational aspects of market entry and market development strategies. It should include timelines for stores to launch, a list of the necessary resources, staffing, the marketing approach, and performance monitoring following the store opening. By strategically opening pilot stores, retailers can validate market assumptions and see how they and their franchisees deploy operational processes for effective execution before scaling out.

Leveraging Demographic Analysis and Competitive Landscape

Understanding the demographic landscape and competitive landscape is critical to a successful global expansion plan. Retailers who can measure who the consumers are—age, gender, income levels, lifestyle preferences, and shopping behaviors can improve their product offering and marketing strategies to meet local consumer interests. In more emergent regions such as Africa and the Middle East, demographic studies can show whether cities are growing quickly, whether younger customers dominate, and specific spending preferences. Retailers will use this understanding to optimize product assortments and pricing strategies. At the same time, brands can analyze the competitive landscape to understand who their current competitors are, their positioning, pricing models, store locations, and promotional strategies. Brands can use this dimension of intelligence to see who is serving a market and the intensity of competition in a market, and choose to enter less served spaces. By overlapping dubbing demographic and competitive landscape data, retailers can make strategic decisions not only on marketing and products, but also operations, such as whether or not to hold a product, or how many staff to hire in the first 3 months.

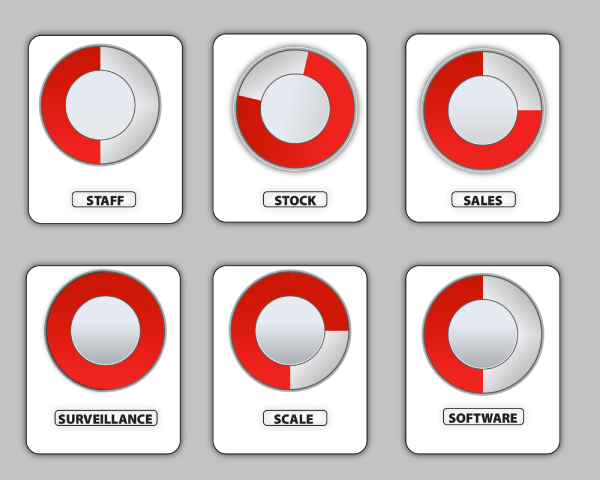

Retail Healthometer

Check the health of your business? Are you ready to organize & scale ?