Spotting the Swirls

Sailing the stream of retail is canopying between opportunities on the surface and risks as the current of that stream. If the bad swirls are not spotted in advance, it can turn things undesirable. While big brands grapple with issues like lapses in cyber security, union strikes, and economic downturns, small and medium retail stores face the brunt of risks like competition and inventory management. Every retail business is subject to risk exposure.

Understanding and mitigating these risks is crucial for retail businesses to ensure smooth continuity. This blog highlights five big retail business risks with a constructive approach to taming them.

Retail Stagnation

If asked about business, one of the most common responses by retailers is ‘market is cold’. By this, they mean less footfall and less sales. This is what stagnancy can feel like. Retail stagnation is a reality and a big risk experienced by all businesses at different points.

Stagnancy in retail emerges for various reasons. Failing to keep things changing tops the list of culprits. Customers do get bored of seeing and experiencing the same values and offerings over time. These include both tangible (e.g. packaging, store front) and non-tangible (e.g. services) elements.

Failing to adapt to changing consumer tastes and preferences is the next big reason. The tastes and preferences of customers are affected by many factors including the emergence of new trends (fashion), social media (awareness, infotainment), actions of competitors, eCommerce, new business models, better value propositions, etc. Not adapting to these changes lowers store footfall.

If there is no dramatic change in the local demographics, then where are the customers buying from? ECommerce does not serve as a convincing answer, at least not for all product categories. People attribute this to all sorts of reasons from politics to economics. Elements from the external environment can indeed affect retail sales but it is like blaming the weather and not carrying out the required measures.

Solution

Retail stagnation can be dealt with in several ways. For starters, innovation and experimentation are the keys. Retailers should not hesitate to try new things. They can tinker with value propositions, try new technologies, redecorate the storefront, alter the interiors, add new elements to improve customer experience, etc. The buzz such changes create is important to keep things interesting to customers.

If footfall is declining, think not only of attracting customers back but also of adding extra punch to their brand experience. Whatever the quantum of footfall, provide better value and services to those customers. Treat this like a reset button where you rebuild your customer base.

In addition to feedback from internal and external stakeholders, data analytics also provide much-needed guidance in formulating informed strategies to overcome stagnation. If reports show that one set of efforts is not working, another should be put into action. Every effort will be an incremental one because of data-based insights and learning from past efforts.

Collaborations with banks and other financial institutions for offers and deals might work if the reasons for stagnation are more economic.

Overstocking and Understocking

Two distinct signs of poor inventory management are overstocking and understocking. Both situations convert into significant challenges for retailers affecting everything from finances to customer experience.

Overstocking traps liquidity affecting the ability to cover other operating expenses. Merchandises that are procured to fulfil any ongoing demand may remain unsold if they are bought in excess resulting in financial losses.

Excess stock levels adversely affect the inventory turnover rate. A higher turnover rate means a longer time to get the investments back and putting stress on working capital.

Holding unnecessary stock also swells the holding costs and eats up space for inventory that may be more relevant at a given point. Overstocking makes store rooms and warehouses unorganised. This physically affects the flow of work and productivity.

The final blow of overstocking comes when retailers resort to offering heavy discounts to clear excess stock. This not only has financial implications but also hurts the brand.

On the other hand, understocking comes with its own set of pain points. It leads to a loss of potential sales and revenue. This is a bad outcome, especially in festive seasons when the purchasing spree is high among customers.

Customer experience and loyalty are also affected if under-stocking persists. If under-stocking situations go unchecked, it is only a matter of time before customers will start considering other stores.

The knee-jerk reaction to under-stocking is to invest in quick restoration of stock levels. This often proves to be costlier and an unorganised approach exhibiting the lack of control.

Solution

Overstocking and under-stocking situations arise because of poor inventory management. The recurring problem of mismatch in stock levels shows two failures. One is the inability to forecast demand correctly. The other is the inability to procure stocks on time. The former problem can be solved by using appropriate demand forecasting tools and techniques. The second problem can be addressed by implementing reliable stock monitoring systems and robust purchase policies and processes. Other important considerations are inventory classification, turnover rates, storing capacities, and SLAs with suppliers.

Competition

Competition is a double-edged sword. On one hand, it leads to creativity and improvement, and on the other, it also exposes businesses to risks of survival and success.

Extreme competition is often followed by price wars among businesses. It is not good for any business in that group because the lowering of prices by one is quickly reciprocated by the others to remain in the fray. This affects the profitability of all the players. Apart from price adjustments, businesses also make changes in their value propositions.

With competition, it is also difficult to maintain the distinguishability of a brand with homogenous products and services. Re-branding and promotional campaigns are used as measures to stand out in the competition leading to additional investments in advertising and promotional campaigns.

The ultimate effect of these competitive actions and counter-actions is that each player is left with uncertainty and a lack of confidence in market behaviour. This hampers the confidence of retailers to come up with effective, long-term business moves.

Given the opportunities that galore in growing economies with suitable demographics, competition is bound to emerge in such markets. Retailers cannot avoid the exposure to the risk of competition.

Solution

Dealing with competition has no specific universal answer. The strategies to deal with competition depend on the nature of competition. For example, a price cut by a competitor can be responded to with a price cut. Home delivery can be responded to with home delivery. Things get trickier when the scope of creating any competitive advantage is thin. However, this is also where getting competitive becomes interesting and calls for revisiting the notions used in retail business model development.

Retailers can focus on identifying and catering to niche markets. This is when a retail business seeks to attain specialisation. Catering to a niche segment involves meeting advanced levels of requirements. For example, a general bakery business can transform into a cake specialist. A cake specialist bakery might offer an extensive range of flavours or custom-made cakes on quick notice.

Enhancing value propositions is also a powerful strategy. It can include an extension of merchandise (wider product mix), superior customer support, personalisation, membership deals and discounts, urgent deliveries, etc.

Going omnichannel in the true sense means having a reliable integration of offline and online capabilities without any compromise on the solo performance of either channel to the applicable extents. Many retail businesses start their online sales channels but are not truly omnichannel. For example, some grocery stores offer online ordering but without any online platform to do so or without a robust delivery system. In such cases, neither of the channels is in a good performing state. The integration of online and offline channels does not mean covering the weaknesses in each other. First, they must both stand as independently working channels with no deficiencies in carrying out their respective functionalities.

A vital requirement to counter competition is ongoing market research. To come up with strategies to counter competition, businesses need to first remain cognizant of the competitive developments. Without this awareness, they cannot take timely action.

In today’s retail scenario, building a strong CRM is highly recommended irrespective of the degree of competition. The reason is that competition is bound to come. The sooner CRM activities start, the more time is available to develop and solidify brand loyalty.

Supply Side Disruptions

Supply-side disruptions come as a big shock to retail brands and businesses. While the implications of these disruptions vary they often catch retailers off guard. Various causes of supply-side disruptions include adverse global/domestic/local events, political standoffs, trade wars and tariffs, union strikes, technological issues, etc. Anomalies in the supply chain can lead to a wide range of consequences. The inability to fulfil orders along the supply chain is the most direct outcome commercially affecting all value chain partners. This supply shortage also leads to unprecedented price hikes whether it is vegetables or microchips. Customers delay their purchasing decisions unless their requirements are important and urgent. Despite low sales, many operational activities and expenses cannot be stopped like payment of rent. If the disruptions persist for long, retailers go lean on staffing. The aftershocks of all these direct and indirect consequences continue to affect businesses for a long time. Recuperating from such down phases is challenging for micro and small businesses.

Solution

The risks of supply-side disruptions are external. However, retailers can prepare their businesses in ways that would minimise the occurrences or the impact of such disruptions.

The first thing to do is bring diversification in the supply chain. Relying on a single source of supply is a risky proposition. Tomorrow, if that one option becomes obsolete even for a short period, facing an inventory crisis is imminent. The possibilities for such obsolescence are always real for many reasons.

Like CRM for customers, retailers should also have strong relationship management with all value chain partners. Communication and close working ties help in anticipating and addressing any potential roadblocks in the future.

Big retail brands must consider the use of the latest technologies like AI to monitor and predict potential disruptions in the supply chains.

While taking the necessary measures helps, the element of uncertainty can never be fully addressed. That is why it is also important to be transparent with customers. It is a good practice to always keep customers informed of the possibilities of supply-side disruptions.

Deteriorating Customer Orientation

Deteriorating customer orientation is common after attaining a certain market stature. It is the ghost in business that every hard and smart working retailer should remain wary of. It is a subtle risk that usually accompanies success. This phenomenon is reflected in various forms.

The falling quality of services by sales staff is one of the signatures of retail brands that have begun to show disregard for customers. Customer support systems become poor in such organisations. They may have scores of branches and counters with a strong digital presence and yet are marred by highly ineffective customer support or grievance redressal mechanisms. HR strategies and processes do not find emphasis in such organisations and it reflects in the expertise and enthusiasm of employees when dealing with customers.

The story does not end there. Unhappy customers share their brand experience with their family and friends amounting to word-of-mouth marketing but towards the undesirable shade. Fake reviews and biased opinions are short-lived. However, if the lack of customer orientation is real, the fire will catch up sooner or later.

Other apparent shreds of evidence of a retail brand lacking customer orientation and disregarding customers are decreased footfall, old customers not coming back, poor reviews on online channels, failing efforts of advertising and personalisation, increasing CAC, etc.

Solution

Service is one area that should find prominence in becoming and staying a customer-oriented retail brand. Customer service and support can be improved in many ways. Providing technical and soft skill retail training to frontline employees is crucial to go beyond routine affairs and resolve grievances and perform par expectations. The use of retail SOPs is highly recommended to help employees execute complex processes and handle difficult situations with ease and effectiveness.

Personalisation is also an effective solution to establish better transactional bonding with customers. However, personalisation should not look like a one-sided business effort to sell more. Unfortunately, even personalisation is becoming standardised nowadays. The right way to approach personalisation is to present unique offers not available in general.

Retail businesses should exercise caution while handling complaints and reviews on online platforms like search engines and social media. Many brands shut off their comment sections or get into an altercation mode when facing negative reviews. Even if a review appears to be biased or motivated, the nature of the response should exhibit a willingness to help and resolve the issue in question.

The presence of customer orientation stands exposed when customer queries or grievances are responded to with bland, generic answers of which customers are already aware. For example, many brands have a presence on X (formerly, Twitter). In many instances, it has been found that companies respond vaguely to customer queries and grievances. Customers see such a lack of transparency and disregard as a red flag. The right way to deal with this is to ensure that proper SOPs are in place leading to effective resolutions instead of redirections.

Feedback and reviews should be welcomed and appreciated followed up by necessary communication on actions taken for resolution.

Recap

Risks are not the same as challenges. Risk is exposure to adverse situations. If risks are left unattended, they can turn into challenges. This applies to retail businesses as well. Five specific risk factors in retail are stagnation, overstocking and under-stocking, competition, supply-side disruptions, and deteriorating customer orientation.

Failing to keep things interesting tops the list of reasons for stagnancy in retail. To deal with this, retailers should be open to trying new things, seek to deliver better CX, focus on existing customer base, use analytics for insights, and consider collaborating with unconventional but potential value chain partners like banks and NGOs.

Overstocking and under-stocking are the outcomes of poor inventory management. These two risks can be tamed by using suitable demand forecasting tools and techniques, implementing reliable stock monitoring systems and placing robust purchase policies and processes.

Competition in retail is as true as the rising of the sun in the east. It leads to price wars, difficulties in maintaining brand distinguishability, and a growing lack of confidence in market behaviour. Countering competition has no universal, fit-for-all solution. The strategies to counter competition depend on the specific conditions and the nature of competition. Still, some proven strategies include catering to niche segments, going omnichannel, enhancing value propositions, and maintaining a robust CRM.

Although supply-side disruptions are external in nature, proper assessments and planning help to minimise the occurrences or contain the impact of such disruptions. Effective solutions to deal with this risk include diversification in the supply chain, building close working ties with supply chain partners, and maintaining transparency with customers.

Deteriorating customer orientation is a subtle risk that usually accompanies business success. It shows up in many forms. The red signs are falling quality of services, poor word-of-mouth marketing, shallow customer support systems, poor reviews on online platforms, falling traction on social media, and more. Some ideal remedies to prevent deteriorating customer orientation are keeping employees up-to-date with the latest training, process improvements, personalisation, maintaining solution-oriented customer support and service systems, and keeping communications meaningful.

For enquiries on retail business solutions or to speak to one of our expert retail consultants, please drop us a message and we will reach out to you.

FAQs

What is risk management in retail?

Risks are those potential outcomes or situations that can cause loss – financial or non-financial to individuals or organisations. When risks become a reality, they can disrupt routine operations and even threaten survival. That is why managing risks is important. Various types of risk exposure in the retail business are:

- Planning and strategic risks (e.g. declining footfall and sales, inability to counter competition)

- Operational risks (e.g. over & under stocking, store safety and security, poor quality output)

- Financial risks (e.g. working capital crisis due to poor retail business planning)

- Supply/value chain risks (e.g. poor performance of suppliers)

- Technological risks (e.g. technology obsolescence)

- Legal and compliance risks (e.g. inability to meet contract/statutory requirements)

By having a proper risk management framework, potential business risks can be identified in advance and appropriate actions/action plans can be put into place.

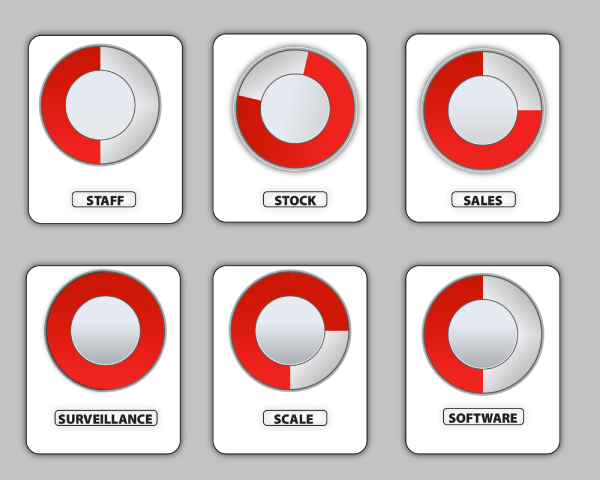

Retail Healthometer

Check the health of your business? Are you ready to organize & scale ?