Harnessing the Power of Merchandising

When it comes to increasing revenues in retail, retailers often tend to focus on roping in big brands, improving visual merchandising, enhancing the interior and exterior design of the store, getting uniforms for sales staff, going for digital marketing, etc. These activities are important. Having brand endorsements make it easier for retailers to increase footfall. Visual merchandising enhances the customer experience in the stores. The design and décor of the store do something similar. The well-trained and uniformed staff shows professionalism. Digital marketing and promotional campaigns help spread the word. But all these activities represent marketing at an exterior level. It may help increase revenues to some extent but it misses out a fundamental force in retailing i.e. merchandising.

Merchandising is an underestimated strategy in retail. Many retailers confuse merchandising with visual merchandising. Merchandising is about what products a retailer chooses to offer for sale. Merchandising strategies affect revenues and profits and more importantly, brand perception. Let us understand the dynamics of merchandising with some grocery examples first. Essential products like cereals, wheat, milk, bread, etc. carry a uniform demand curve throughout the year. Within these products, there are various types and brands. Some product types and brands are preferred more by customers. And even within these preferences, there are popular selling sizes. For example, packaged milk from local dairy farms comes in the standard size packaging of half a litre. Then there is the factor of margin associated with different packaging sizes, products and brands. The goal of merchandising is to maximise revenue and profits by selecting the right match of product, packaging size, brand, or any other relevant consideration in the right quantities. Beyond certain established standards, retailers have a free hand in determining how they should break down the market demand to arrive at the best merchandising strategy for their retail business.

The fundamentals of merchandising strategies are applicable across industries and channels. For example, for an electronics retailer, if power banks are performing better with the eCommerce channel, it would make sense for the retailer to sell power banks from the warehouse and save store space for other products that sell better from the store. For a fashion store, if thermal wear products experienced a high volume of sales in the previous winter, it would be a sensible business decision to stock up not just thermal wear products but also similar products like mufflers, sweaters, woollen gloves, etc. This is where fashion merchandising research helps fashion retailers.

We can also use instances from the retail furniture business. The emergence of the concept of quick furniture revolutionised the furniture industry around the world. Furniture, otherwise an expensive category of product, found a whole new customer segment seeking furniture products made of industrial plastic and steel that are easy to carry and assemble. But it was not the end of traditional wooden-based furniture businesses. This is a case where old-fashioned furniture businesses had to innovate with their product line extension strategy and expand their product mix by introducing new products to cater to the new market realities. This is also a case where they had to move their traditional offerings to niche market segments. With the right merchandising strategies, retailers could not only bring turnaround performances with their revenues and profits but also save their businesses.

Further in this blog, we shall discuss the steps in merchandising planning and how merchandising analysis is done by modern-day retail brands, experts and strategists. We will cover how data analytics could affect the product merchandising decisions of retail businesses. The methodologies used in formulating merchandising strategies and decision-making will be explained in detail. We shall also see how merchandising strategies could be put to use by retail brands and businesses in various industries like fashion, grocery, furniture, beauty and cosmetics, and pharmacy.

Data Analytics – the new way of Merchandising

Data analytics has touched every sphere of business and merchandising is no exception. When we say data analytics for merchandising, there can be two sets of data – historical and trending.

Historical data refers to the data a retail business already possesses of its past sales performances. It is helpful for retailers to churn out meaningful sales information across the product mix and timelines. For example, a bakery business could find out what flavours of cakes it sells the most based on historical data. It could also derive what quantity sizes are sold the most. Adding the timeline variable, the business could further improve its understanding of seasonal demand. Going advanced, it could also be determined if certain products could be sold directly to customers via eCommerce and what kind of distance radius must be brought under the free delivery limits. All this information and insights are vital for businesses to reach out to customers with the right product offering through the right channel and timing.

A big demerit with historical data is that it is limited and it speaks of the past and not the current trends and developments. Trending data takes care of this problem. Access to new and updated data points has become vital for retailers to keep up with the evolving needs and preferences of customers. But retailers must also caution themselves for overrating trending data. Trending data is more useful to retailers when they want to try new product offerings. For example, a bakery business may want to add pizza and pasta to its offerings. Here, trending data may be useful to predict the local demand. But if the bakery uses trending data to question its existing sales, it will end up making a mess out of nothing.

Data-driven product merchandising is also helpful in determining the price elasticity of products. This lets retailers slice their margins and set the prices just at the tipping point. Extending the bakery example from above, it may be examined by the bakery owner if, in the past, any small change in the price of a selected product brought any significant difference in its sales. By adjusting the prices, the margin per unit may fall but it may increase the number of units sold compensating for the margin loss with increased overall profits from total sales of the product.

Merchandise planning in retail and decisions made out of such planning also affect the inventory turnover capabilities of retail businesses. This is where numerical accuracy becomes important. Merchandising decisions can no longer be made only out of intuition and business acumen. There are carrying costs involved in storing inventory. Slower cycles translate to higher carrying costs. With data-driven product merchandising, retailers can be more accurate with their demand forecasts and inventory storage.

In merchandising analytics, eCommerce retail businesses are in a more advantageous position over their brick and mortar counterparts. Online businesses are capable of generating data related to web traffic and visitor behaviour. Using advanced analytics, they are better poised to understand what is working for them and what is not.

Methodology for Merchandising in Retail – strategy, Planning and Decision-Making

Demand Rating

Demand rating or demand analysis is one of the primary tools used in merchandising planning. It uses predictive analysis to forecast the demand for products in the near future. In merchandising planning, demand analysis is used to classify high-performing and low or non-performing products. Retailers can shift their focus on products that matter. These products could be already in offering or might be potential additions. The data used for analytics could be historical or obtained from business intelligence and secondary market research. Market research for understanding retail consumers is essential in merchandising planning. With internal data, retailers can identify which products need more attention and which ones can be put off the shelves for now. This is purely based on the past performance of products. It can also help in identifying similar or complementary products that can be added to the existing portfolio. Retailers need to exercise a certain degree of caution while relying on internal data. They need to also math in what kind of marketing efforts they had put into selling those ‘performing’ products and the prevailing external factors. For example, many products like toilet papers and hand-washing soaps performed exceedingly well during the lockdown period of the year 2020 with little or no effort on the part of retailers. The situation is no longer the same. If those numbers are blindly relied upon, it could result in a merchandising blunder. A corrective perspective could be obtained with the demand analysis using contemporary market data.

Fast Mover Analysis

Every retailer would know that there are fast-moving and slow-moving products. Fast movers endow several advantages. Retailers know these products sell quicker with a high degree of certainty. The revenue and profits are certain to be achieved within a short and known timeframe. Not much effort has to be exerted to sell these products. This is typical with grocery and departmental stores. They have no time to waste on uncertain products. They are not willing to store anything but fast movers. But every retail business has its own list of fast and slow-moving goods. For instance, a pharmacy business experiences shorter inventory cycles with their paracetamol products than maybe for Tetanus IVFs. Fast movers, especially in the branded category, carry less margin but retailers expect or are expected to gain over volume sales. Fast movers also do not always remain the fast movers. Extending the retail pharmacy example, there are seasons when medicines for cough, cold, fever, or upset tummies peak. Especially, during the change of weather, the demand for these medicines skyrockets. Retailers must know, predict, and merchandise their stock as per the realities of what will move fast and what will not.

Slow-moving products are good to be stored as long as they offer good margins and promise the certainty of sale. For example, it may make no business sense for a retail pharmacy store to keep stretchers for sale. Customers who may seek it are likely to get it from a medico-surgical store.

Margin Feasibility

Even if a product exhibits positive demand ratings and falls in the category of fast-moving inventory, the concern of margin feasibility still remains. If a fast-moving product despite the anticipated generous volume of sales yields a low average margin, it might not be worthy of a space on the shelves. Profiting is the ultimate goal of business. A fast-moving product mix with good average margin levels should be the target of every retailer. However, the margin is a relative term. Retail giants can afford to slice their margins. But for a small or medium retail business, such margins may be unthinkable. Hence, they should focus on what their margins allow them to play with. The role of margin assessments in merchandising is not to enable businesses to compete with the behemoths but to focus on their target markets within a given geography. How much price discounts are offered by the next-door competitors? That should be the concern of retailers within the ambit of their competitive ambitions. The same goes for retail giants. If you have ever noticed, the prices of certain products across different online marketplaces remain unflinching. This is because irrespective of the demand and how eagerly customers might be willing to buy those products, the margins do not allow the listed retailers to set their prices any lower.

Investment Risk

All the steps followed so far – demand analysis, fast versus slow-moving inventory classification and margin feasibility are done with the objective of determining a profitable merchandising mix. But these are all forecasts for the future. There is always an element of risk involved with merchandising planning and decisions. The forecasts and assessments may not come true. These reasons are unpredictable. For example, a bakery business may experience that their best selling products are performing poorly. And there may be absolutely no established reason for the same. A pharmacy store may experience below-average footfall and all that could be concluded is that people are actually in good health during the given period. Sometimes there are MOQs imposed by big and exclusive suppliers. That further increases the demand risk exposure of retailers.

There are investment risks also emanating from the supply side. Once a retailer decides to direct investments into a particular product mix, it closes the door for other brands and product options. Sometimes suppliers fail to fulfil their orders because of internal problems or factors beyond their control. Shortage of supply means that retailers will not be able to pull their merchandising strategies in the given period. This is common with many local departmental stores. The unfortunate part is that they stop paying attention to their inabilities in making those products available in the stores that customers seek. Even more unfortunate is that they begin to resort to alternative brands and leave customers with no option.

Retailers need to accept that they always run certain investment risks in merchandising. The demand-induced risks could be minimised with a certain degree of flexibility in their merchandising strategies and proactive marketing and promotional efforts. The supply-side risks could be reduced with better negotiation and stricter compliance conditions with the suppliers.

Leveraging Product Portfolio

The overall product or merchandising mix presented for sale is the product portfolio for retailers. The entire set of merchandise that retailers offer to sell constitutes a critical element of their retail branding strategy. For example, a retail pharmacy store may add health insurance policies in its product portfolio via collaboration with any selected health insurance company. It suddenly alters the brand perception of the business. From selling medicines as a pharmacy to offering health insurance, it is a brilliant leap forward in terms of branding with product range planning. This is the power of product line and brand extension. But it should never appear as upselling or cross-selling. The right product at the right place never fails to find its audience. That is what makes business so much exciting. But retailers have to be careful in showing ingenuity with their product portfolio. The same health insurance idea would be catastrophic for a wine shop.

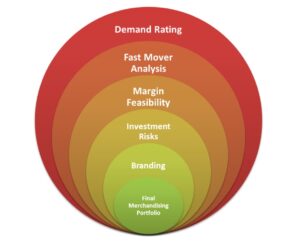

A funnel representation of arriving at the final merchandising portfolio

Yes, it is possible to boost the revenues and profitability of any retail business with a sensible and systematic approach towards merchandising. It is all about understanding in great detail what your customers are seeking or would be seeking. Whether you use external research or internal historical data, the bottom line goal is that it should lead you to specify what merchandise your customers will have their eyes on. Focusing on products that matter is the key to success in merchandising strategy and planning. Business acumen and intuition with data-driven analytics is the best foot forward for retailers. There will always be risks but some risks are always worth assuming.

About YRC

YRC is a boutique retail business consulting firm. Over the past 12 years, we have offered business solutions and services to over 500 clients in more than 20 verticals. Our business philosophy is not only to deliver solutions but also to work with clients as partners for mutual growth and success. With a growing international presence, we seek to emerge as one of the finest retail consulting firms in the world dedicated to providing the best business solutions.

YRC’s consulting services are designed and delivered by a team of expert retail and eCommerce consultants. We deploy qualified eCommerce and retail specialist consultants with rich and relevant industry and project exposure. Work from home or work from office, our flexible working system is aimed at ensuring that our services are always on schedule. We work in close coordination with our clients through our robust feedback and reporting mechanism. For service design and delivery, we bank upon our vast repository of tested and proven solutions with extensive groundwork and customisations to frame the best solutions for our clients.

Retail Healthometer

Check the health of your business? Are you ready to organize & scale ?