From 1st July 2017, India has stepped into the much-awaited GST regime (country’s single largest tax reform since independence). GST will integrate country’s economy which is roughly worth $2 trillion and a vast customer base of 1.3 billion into one common market. GST is applicable to all businesses (supply of goods and services, trading, profession, vocation etc). It is time for businesses to gear themselves up to this new indirect tax environment. Major overhauls will be required in business processes, IT and ERP programs, staff training and marketing to incorporate the new taxation rules and regulations so that businesses are equipped to avail the benefits of and comply with the GST regime which will eventually lead them to remain competitive and compatible with its environment.

GST Registration

Under GST, a person or a business entity which is already registered in a state under any existing law will have to migrate to GST. Similarly, unregistered entities will have to get themselves registered under GST as per the given provisions. Having a PAN is mandatory for GST registration. Non-residents can apply for GST registration by other documents as notified by the appropriate authority. Separate GST registration shall be required for each state of operation and for each business vertical in a state. Persons and entities liable to get registered or migrated to GST are mentioned below.

Under GST, a person or a business entity which is already registered in a state under any existing law will have to migrate to GST

- Every person with a turnover exceeding Rs.20 Lakhs (Rs.10 Lakhs for the North-Eastern States including Sikkim) in a financial year.

- Interstate supplier of goods and services

- Casual Taxable Person

- Non-Resident Taxable Person

- Agents who act on behalf of supplier

- Persons required to pay taxes under Reverse Charge Mechanism

- Distributors or Input Service Distributor

- E-Commerce operator and persons who supply through an e-commerce operator

- Aggregator

- Any person supplying online information and database access/retrieval services from outside India to a person or entity in India (other than a registered taxable person)

- Any person who is required to deduct TDS under GST.

Note: Person includes Individuals, HUF, Company, Firm, Society, Trust etc. GST is not applicable to Agriculturists. Agriculture includes floriculture, horticulture, sericulture, cultivation of crops, grass or garden produce and does not include dairy farming, poultry farming, fruit gathering, plant rearing etc. GST registration is crucial because it is mandatory (as applicable) and will entitle businesses to avail various benefits under GST. GST-registered businesses will be able to avail to input tax credit. Timely registration will help businesses avoid attracting penalties from tax authorities. Persons and entities registering under GST will be assigned with a unique GSTIN (Goods and Services Tax Identification Number.

Changes in Accounting and TAX Treatment Under GST

In the erstwhile taxation system, businesses had to maintain separate accounts for VAT, CST, Service Tax etc. Various accounts required to be maintained by businesses before GST is given below (8):

- Excise Payable a/c

- CENVAT Credit a/c

- Output VAT a/c

- Input VAT a/c

- Input Service Tax a/c

- Output Service Tax a/c

- CST a/c

Post-GST, the existing indirect taxes will be subsumed and brought under GST. Some of the important accounts required to be maintained under GST regime are (8):

- Input CGST a/c

- Output CGST a/c

- Input SGST a/c

- Output SGST a/c

- Input IGST a/c

- Output IGST a/c

- Electronic Cash Ledger (Recordkeeping on the authorized GST Portal)

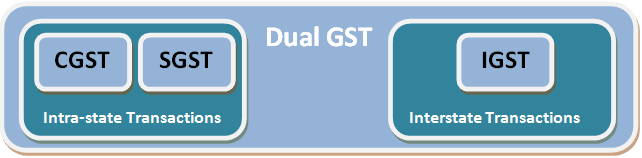

The tax rate applicable will depend on the product/service and the type of GST (CGST, SGST and IGST) applicable will depend on the source and destination of supply of goods and services. Businesses can now offset their input tax (with purchases) with output tax (from supply/sales). For interstate transactions, IGST is applicable and for intra-state transactions, both CGST and SGST will be applicable.

|

Tax Collected (Output Tax Liability) |

Taxes paid (Input Tax Credit) – Setting off order | Balance |

|

CGST |

CGST, then IGST | Tax payable |

| SGST | SGST, then IGST |

Tax payable |

| IGST | IGST, CGST, SGST |

Tax payable |

For accounting purposes, businesses will have to follow GAAP under GST and books of accounts have to be maintained for five years from the due date of filing the annual return of the particular year.

Input Sources – (8)

Changes in Business Process – Finance and Accounts, IT and Logistics

Under the erstwhile taxation system, indirect taxes were levied on the manufacture or the sale of goods and services. But with GST, the taxation will be based on the source and destination of the supply of goods and services. This will affect and will require changes in various business processes like finance, IT and logistics. The new rules and regulations will have to be incorporated in the finance ERP so that businesses can process its financial transactions like purchase, sale, billing, invoicing, claiming input tax credit and comply with the provisions of the new GST regime. Under GST, a normal taxpayer will have to submit three monthly returns and one annual return. Similarly, different persons registered under different provisions of GST (e.g. casual registration, composition scheme etc) will have to furnish different returns as per rule. There are altogether 11 main types of return forms (GSTR 1 to GSTR 11) for different persons or entities registered under GST for filing different information to the tax authorities subject to the given deadlines.

The new rules and regulations will have to be incorporated in the finance ERP so that businesses can process its financial transactions like purchase, sale, billing, invoicing, claiming input tax credit and comply with the provisions of the new GST regime

The aforesaid returns have to be filed online which makes it important for businesses to incorporate the necessary changes in its IT infrastructure and information systems. It also becomes imperative for businesses to make sure that the returns are filed on time to avoid penalties. With the subsuming of Octroi, businesses will also experience smoothness in its logistics and interstate supply of goods. Companies may also have to adjust and reposition their supply chain and logistics network to make the most out of the GST framework. SOPs can give a competitive edge to organizations in this transitional phase. Finance and Accounts SOPs can significantly help companies smoothly incorporate and execute the GST provisions applicable to their businesses. Because GST is new to everybody including the employees deputed in the finance, accounts and purchase department of a business enterprise, by integrating the working provisions and the compliance requirements of GST with the existing SOPs in the affected departments, the concerned employees will be in a much better position to execute their GST-affected duties and responsibilities like invoicing, filing returns, claiming input tax credits etc. This will help ensure that the regular flow of business operations is not affected, deadlines are not missed and other compliances are duly fulfilled. Hence, it is important for businesses to redefine their SOPs especially for the accounts & purchase department.

compliance requirements of GST with the existing SOPs in the affected departments, the concerned employees will be in a much better position to execute their GST-affected duties and responsibilities like invoicing, filing returns, claiming input tax credits

Input Sources – (5)

HR: Staff Training

The new set of rules, regulations and compliances will also bring changes in the business processes, operations and activities of an organization especially in the finance/accounts, purchase, logistics/supply chain and marketing. The resultant changes in the business processes will have a bearing on the job descriptions and job specifications in the affected departments of a business enterprise. Employees, at all levels, have to be educated and trained on incorporating and executing the GST guidelines and provisions. Every business enterprise has to make sure that their accounts team is updated with GST rules applicable to the products and services.

The resultant changes in the business processes will have a bearing on the job descriptions and job specifications in the affected departments of a business enterprise

A brief layout of the GST tax structure for different products and services is presented below.

|

Tax Rate |

Goods and Services |

|

0% (No Tax) |

Salt, Milk, Eggs, Curd, Lassi, Unpacked Food grains. Unpacked Paneer, Jaggery, Natural Honey, Fresh Fruits & Vegetables, Flour, Besan, Bread, Sindoor, Kajal (not sticks), Bindi, Bangles, Handloom, Judicial Papers, Printed Books, Cereal Grains, Hotels & Lodges with tariff below Rs.1000 etc. |

|

5% |

Sugar, Tea, Edible Oils, Domestic LPG, PDS Kerosene, Cashew Nuts, Milk Food for Babies, Fabric, Spices, Coal, Life-Saving Drugs, Apparels < Rs.1,000, Footwear < Rs.500, Skimmed Milk Powder, Branded Paneer, Coffee, Spices, Frozen Vegetables, Medicines, Insulin, Postage & Revenue Stamps, Railways, Airlines, Small Restaurants etc.

|

|

12% |

Mobile Phones, Business Class Air Tickets, Non-AC hotels, Butter, Ghee, Cheese, Almonds, Apparels > Rs.1000, Frozen Meat Products, Packaged Dry Fruits, ketchups, Fruit Juices, Bhujia & Namkeen, Spectacles, Ayurvedic Medicines, diagnostic kits and reagents, work contracts, Colouring & Picture Books, Exercise & Note Books, Umbrella, Sewing Machines, Ketchups & Sauces, Work Contracts etc. |

|

18% |

AC Hotels that serve liquor, Telecom Services, IT and Financial Services, Software, Trademark, Goodwill, Branded Garments, Footwear > Rs.500, Biscuits, Pastries, Mayonnaise, Jams, Steel Products, Aluminium Foil, Curry paste & Salad Dressings, Mineral Water, Ice-Creams, Cameras, Speakers, Monitors, Printer, CCTV, Swimming Pools, Hair Oil, Toothpaste, Soap, Pasta, Corn Flakes, Soups, Room Tariff between Rs.2,500 to Rs.7,500, Restaurants inside 5 Star Hotels etc. |

|

28% |

Small Cars, Consumer Durables – AC, Fridge, Washing Machines, Vacuum Cleaners, Water Heater Shavers, Dish Washers. Five Star Hotels and Hotels with room tariffs above Rs.7,500, Cinema, Deodorants, Shaving Creams, Aerated Water, Sunscreen, After Shave, Hair Shampoos, ATM, Automobiles and Two-Wheelers, Chewing Gums, Pan Masalas etc. |

Realignment of Marketing Strategies: Pricing, Competition and Arrangements

With the removal of the cascading effect of taxes, prices of products and services are expected to come down. GST might unleash competitive price wars as businesses under GST will get some space to play around with their profit margins. Also, with a uniform taxation environment on goods and services across the country which bring tax-neutrality and with lesser compliance hassles, businesses across the country will seek to explore new markets in different states. With an increase in competition and surge in pricing competitiveness, businesses will have to revisit their pricing and marketing strategies in the light of the new tax regime. Also, contracts and agreements with suppliers, distributors and clients may have to be renegotiated and modified to absorb the impact of GST on the parties involved in the value-chain process.

With an increase in competition and surge in pricing competitiveness, businesses will have to revisit their pricing and marketing strategies in the light of the new tax regime

While GST brings in a host of benefits for the business community in the country, it also brings certain obligations on the part of the business organizations to get themselves registered with GST and comply with its provisions. With the new set of rules and regulations of taxation, businesses will have to address their tax positions and accounting procedures from the GST perspective. And with these changes in effect, organizations will have to uplift their business processes (Finance, IT, Logistics etc) so that they remain in compliance with this new regulatory framework. The opening up of the market floodgates with GST presents a sea of opportunities for companies and business enterprises of all sizes to revisit their marketing strategies and fiercely pursue business growth and expansion. The simplified and uniform tax mechanism is a motivating incentive for budding entrepreneurs with dream retail projects.

YRC Related Articles: How to Write SOPs for Marketing?, 6 Ways To Grow Your Business, How to Start a Retail Business in India, Business Expansion Plan for Small Entrepreneurs, Six Steps to Writing a Great SOP for Retail, How to write SOPs for an Apparel Brand?, How to Develop SOPs for Quick Service Restaurant?, How to write SOPs for Furniture Showroom

Author Bio

Varun Shah

Chief Finance Officer